Asked by Lucky Baloyi on Jun 14, 2024

Verified

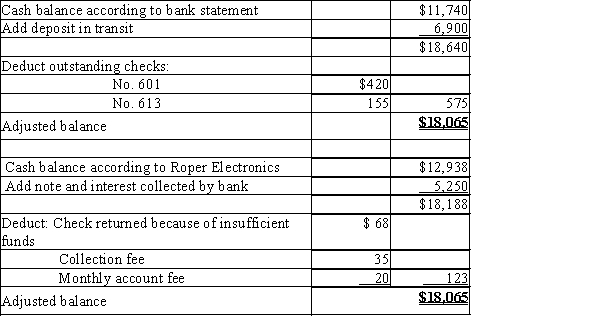

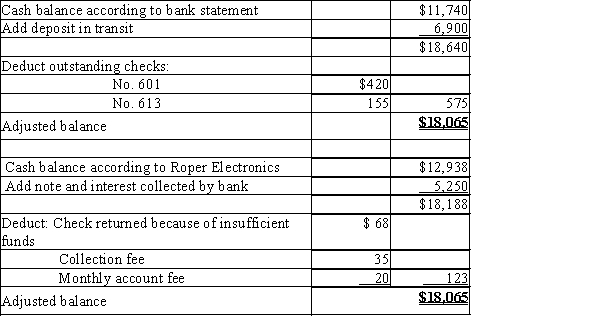

Roper Electronics received its bank statement for the month of August with an ending balance of $11,740. Roper determined that Check No. 613 for $155 and Check No. 601 for $420 were both outstanding. Also, a $6,900 deposit for August 30 was in transit as of the end of the month. Northern Regional Bank also collected a $5,000 notes receivable on August 1 that was issued March 1. Accrued interest is $250. Northern Regional Bank charged a $35 fee for the collection service. The bank statement reveals a bank service charge of $20. A customer check for $68 was returned with the bank statement marked "NSF." The ending balance of the Roper cash account is $12,938.?Prepare a bank/account reconciliation and any necessary journal entries for the reconciliation.

Deposit In Transit

Refers to money that has been received and recorded by a business but has not yet been recorded by the bank.

Bank Statement

A document issued by a bank to its customer listing transactions, including deposits, withdrawals, and fees over a specific period, usually monthly.

Outstanding Checks

Checks that have been written and recorded in a company's books but have not yet been cleared or cashed by the bank.

- Pinpoint and expound on the parts of a bank reconciliation and its essentiality.

Verified Answer

AN

Ashley NelsonJun 14, 2024

Final Answer :

??  Aug. 31 Cash 5,215 Bank Service Charge Expense 35 Notes Receivable 5,000 Interest Revenue 25031 Bank Service Charge Expense 20 Cash 2031 Accounts Receivable 68 Cash 68\begin{array} { | r | l | r | r | } \hline \text { Aug. } 31 & \text { Cash } & 5,215 & \\\hline & \text { Bank Service Charge Expense } & 35 & \\\hline & \text { Notes Receivable } & & 5,000 \\\hline & \text { Interest Revenue } & & 250 \\\hline & & & \\\hline 31 & \text { Bank Service Charge Expense } & 20 & \\\hline & \text { Cash } & & 20 \\\hline & & & \\\hline 31 & \text { Accounts Receivable } & 68 & \\\hline & \text { Cash } & & 68 \\\hline & & & \\\hline\end{array} Aug. 313131 Cash Bank Service Charge Expense Notes Receivable Interest Revenue Bank Service Charge Expense Cash Accounts Receivable Cash 5,2153520685,0002502068

Aug. 31 Cash 5,215 Bank Service Charge Expense 35 Notes Receivable 5,000 Interest Revenue 25031 Bank Service Charge Expense 20 Cash 2031 Accounts Receivable 68 Cash 68\begin{array} { | r | l | r | r | } \hline \text { Aug. } 31 & \text { Cash } & 5,215 & \\\hline & \text { Bank Service Charge Expense } & 35 & \\\hline & \text { Notes Receivable } & & 5,000 \\\hline & \text { Interest Revenue } & & 250 \\\hline & & & \\\hline 31 & \text { Bank Service Charge Expense } & 20 & \\\hline & \text { Cash } & & 20 \\\hline & & & \\\hline 31 & \text { Accounts Receivable } & 68 & \\\hline & \text { Cash } & & 68 \\\hline & & & \\\hline\end{array} Aug. 313131 Cash Bank Service Charge Expense Notes Receivable Interest Revenue Bank Service Charge Expense Cash Accounts Receivable Cash 5,2153520685,0002502068

Aug. 31 Cash 5,215 Bank Service Charge Expense 35 Notes Receivable 5,000 Interest Revenue 25031 Bank Service Charge Expense 20 Cash 2031 Accounts Receivable 68 Cash 68\begin{array} { | r | l | r | r | } \hline \text { Aug. } 31 & \text { Cash } & 5,215 & \\\hline & \text { Bank Service Charge Expense } & 35 & \\\hline & \text { Notes Receivable } & & 5,000 \\\hline & \text { Interest Revenue } & & 250 \\\hline & & & \\\hline 31 & \text { Bank Service Charge Expense } & 20 & \\\hline & \text { Cash } & & 20 \\\hline & & & \\\hline 31 & \text { Accounts Receivable } & 68 & \\\hline & \text { Cash } & & 68 \\\hline & & & \\\hline\end{array} Aug. 313131 Cash Bank Service Charge Expense Notes Receivable Interest Revenue Bank Service Charge Expense Cash Accounts Receivable Cash 5,2153520685,0002502068

Aug. 31 Cash 5,215 Bank Service Charge Expense 35 Notes Receivable 5,000 Interest Revenue 25031 Bank Service Charge Expense 20 Cash 2031 Accounts Receivable 68 Cash 68\begin{array} { | r | l | r | r | } \hline \text { Aug. } 31 & \text { Cash } & 5,215 & \\\hline & \text { Bank Service Charge Expense } & 35 & \\\hline & \text { Notes Receivable } & & 5,000 \\\hline & \text { Interest Revenue } & & 250 \\\hline & & & \\\hline 31 & \text { Bank Service Charge Expense } & 20 & \\\hline & \text { Cash } & & 20 \\\hline & & & \\\hline 31 & \text { Accounts Receivable } & 68 & \\\hline & \text { Cash } & & 68 \\\hline & & & \\\hline\end{array} Aug. 313131 Cash Bank Service Charge Expense Notes Receivable Interest Revenue Bank Service Charge Expense Cash Accounts Receivable Cash 5,2153520685,0002502068

Learning Objectives

- Pinpoint and expound on the parts of a bank reconciliation and its essentiality.