Asked by Miquan Patton-Martin on Jun 17, 2024

Verified

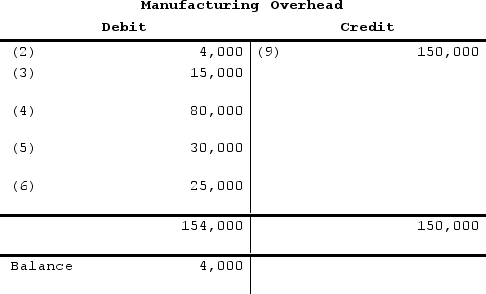

Refer to the T-account below:  Entry (4) could represent which of the following except?

Entry (4) could represent which of the following except?

A) Indirect labor cost incurred.

B) Factory insurance cost.

C) Overhead cost applied to Work in Process.

D) Depreciation on factory equipment.

Indirect Labor Cost

Expenses associated with employees who assist in the production process indirectly, such as maintenance and janitorial staff, contributing to the overall production environment.

Factory Insurance Cost

The premiums paid for insurance policies that protect manufacturing facilities and operations against risks like fire, theft, or worker injuries.

Overhead Cost Applied

The amount of indirect costs allocated to a particular cost object, such as a product or project, based on a predetermined overhead rate.

- Identify the distinctions among types of expenses and their application in manufacturing financial records.

- Acquire knowledge on the role of manufacturing overhead in product cost formulation.

Verified Answer

Learning Objectives

- Identify the distinctions among types of expenses and their application in manufacturing financial records.

- Acquire knowledge on the role of manufacturing overhead in product cost formulation.

Related questions

Entry (4) in the T-Account Below Represents Raw Materials Requisitioned ...

Entry (1) in the Below T-Account Represents the Purchase Rather ...

The Absorption Cost Approach Provides for the Absorption of All ...

When Manufacturing Overhead Is Applied to Production, It Is Added ...

The Following Account Balances Has Been Extracted from Jimbob Co ...