Asked by Abigail Kooiker on Jun 12, 2024

Verified

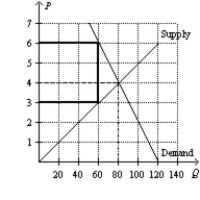

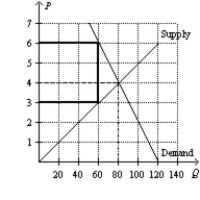

Refer to Figure 8-10. Suppose the government places a $3 tax per unit on this good. How many units of this good will be bought and sold after the tax is imposed?

Units Bought

The quantity of a product that consumers purchase at a given price.

Tax Imposed

A financial charge or other levy instituted by a government on an individual or an entity to raise revenue for public purposes.

- Recognize the implications of taxes on market equilibrium, including adjustments in consumer surplus, producer surplus, and deadweight loss.

Verified Answer

SM

Shaghayegh MehrvarzJun 14, 2024

Final Answer :

60 units will be bought and sold after the tax is imposed.

Learning Objectives

- Recognize the implications of taxes on market equilibrium, including adjustments in consumer surplus, producer surplus, and deadweight loss.