Asked by Sydnee Frakes on Jul 14, 2024

Verified

Prosner Corp.manufactures three products from a common input in a joint processing operation.Joint processing costs up to the split-off point total $500,000 per year.The company allocates these costs to the joint products on the basis of their total sales value at the split-off point.

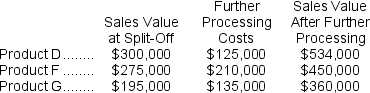

Each product may be sold at the split-off point or processed further.The additional processing costs and sales value after further processing for each product (on an annual basis)are:  Required:

Required:

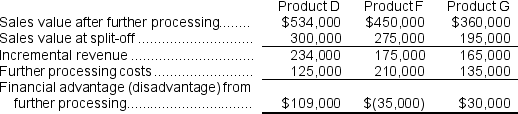

Which product or products should be sold at the split-off point, and which product or products should be processed further? Show computations.

Joint Processing Costs

The expenses incurred during the initial stages of processing where multiple products are produced simultaneously before they are split into separate components.

Split-off Point

The stage in a production process where multiple products are derived from a single input or process, each taking a different processing route afterward.

Sales Value

The total revenue generated from the sale of goods or services by a company during a particular period.

- Understand the concept of joint processing and decide on further processing or sale at a split-off point.

Verified Answer

Products D and G should be sold after further processing beyond the split-off point.Product F should be sold at the split-off point without any further processing.

Products D and G should be sold after further processing beyond the split-off point.Product F should be sold at the split-off point without any further processing.

Learning Objectives

- Understand the concept of joint processing and decide on further processing or sale at a split-off point.

Related questions

Swagger Corporation Purchases Potatoes from Farmers ...

Ibsen Company Makes Two Products from a Common Input ...

Bowen Company Produces Products P, Q, and R from a ...

Farrugia Corporation Produces Two Intermediate Products, a and B, from ...

The Joint Cost Allocation Method That Recognises the Revenues at ...