Asked by V?n Linh Nguy?n on Jun 26, 2024

Verified

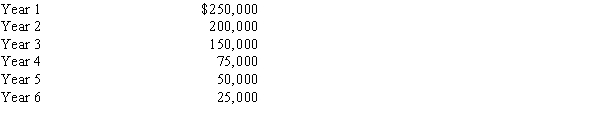

Proposals M and N each cost $550,000, have six-year lives, and have expected total cash flows of $750,000. Proposal M is expected to provide equal annual net cash flows of $125,000, while the net cash flows for Proposal N are as follows:??  Determine the cash payback period for each proposal.

Determine the cash payback period for each proposal.

Cash Payback Period

The length of time it takes for an investment to generate enough cash flow to recoup the original investment.

Annual Net Cash Flows

The net amount of cash that is received or expended by a business during a year, after all cash inflows and outflows are accounted for.

Expected Total Cash Flows

The anticipated sum of all cash inflows and outflows associated with an investment over a specific period.

- Compute and comprehend the significance of the cash payback period in making investment choices.

Verified Answer

AP

Akash PolakampalliJul 01, 2024

Final Answer :

Proposal M: $550,000/$125,000 = 4.4 yearsProposal N: $250,000 + $200,000 + 2/3

($150,000) = $550,000 = 2 2/3 years

($150,000) = $550,000 = 2 2/3 years

Learning Objectives

- Compute and comprehend the significance of the cash payback period in making investment choices.