Asked by Sheryl Kambuni on May 29, 2024

Verified

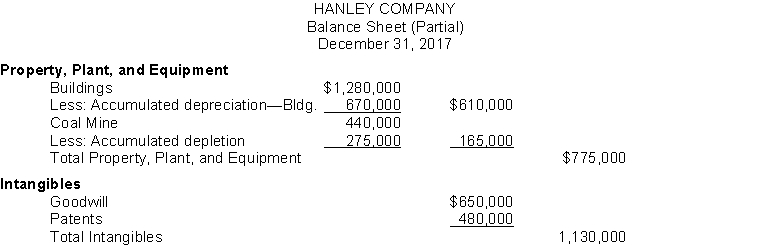

Presented below is information related to plant assets natural resources and intangibles at year end on December 31 2017 for Hanley Company: Buildings $1,280,000 Goodwill 650,000 Patents 480,000 Coal Mine 440,000 Accumulated Depreciation-Bidg. 670,000 Accumulated Depletion 275,000\begin{array}{lr}\text { Buildings } & \$ 1,280,000 \\\text { Goodwill } & 650,000 \\\text { Patents } & 480,000 \\\text { Coal Mine } & 440,000 \\\text { Accumulated Depreciation-Bidg. } & 670,000 \\\text { Accumulated Depletion } & 275,000\end{array} Buildings Goodwill Patents Coal Mine Accumulated Depreciation-Bidg. Accumulated Depletion $1,280,000650,000480,000440,000670,000275,000 Instructions

Prepare a partial balance sheet for Hanley Company that shows how the above listed items would be presented.

Accumulated Depreciation

The total amount of depreciation expense that has been recorded against a fixed asset since it was acquired.

Accumulated Depletion

The total amount deducted from the gross value of an asset to account for the extraction of natural resources over time.

Coal Mine

A physical location where coal is extracted from the earth.

- Gain knowledge on the accounting for natural resources, including the depletion process.

- Learn how to prepare a partial balance sheet for assets and account for transactions affecting shareholders' equity.

Verified Answer

Learning Objectives

- Gain knowledge on the accounting for natural resources, including the depletion process.

- Learn how to prepare a partial balance sheet for assets and account for transactions affecting shareholders' equity.

Related questions

Natural Resources Have Two Distinguishing Characteristics (1) They Are Physically ...

The ___________________ Is Calculated by Dividing Net Sales by Average ...

Minerals Removed from the Earth Are Classified as Intangible Assets

A Company Purchased a Special Purpose Machine on September 15 ...

Describe the Accounting for Natural Resources,including Their Acquisition,cost Allocation,and Account ...