Asked by Jamie Wilson on Jun 24, 2024

Verified

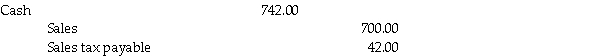

Prepare the necessary general journal entry for April 16.

__________________________________________ __________ __________

__________________________________________ __________ __________

__________________________________________ __________ __________

General Journal

A fundamental accounting ledger where all financial transactions are initially recorded, employing a double-entry system.

Sales Tax

A tax imposed by government on sales of goods and services, collected by the seller and passed on to the government.

Cash Customer

A customer who pays for goods or services with cash at the time of purchase rather than buying on credit.

- Acquire the skill to record journal entries for sales made in cash and on credit, along with the necessary adjustments for sales returns and allowances.

- Compute sales tax on transactions and comprehend its effects on sales and returns.

Verified Answer

SG

Learning Objectives

- Acquire the skill to record journal entries for sales made in cash and on credit, along with the necessary adjustments for sales returns and allowances.

- Compute sales tax on transactions and comprehend its effects on sales and returns.