Asked by Jincy Robin on May 10, 2024

Verified

Prepare the journal entries to record the following transactions for Ogleby Company which has a calendar year end and uses the straight-line method of depreciation.

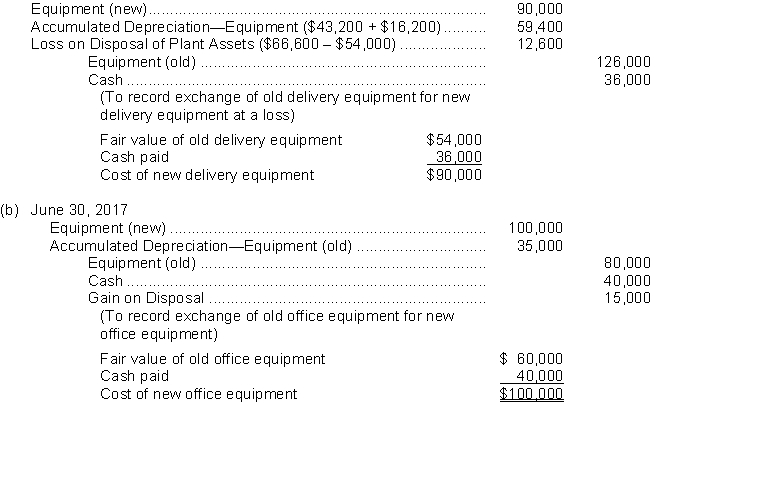

a) On September 30 2017 the company exchanged old delivery equipment and $36000 for new delivery equipment. The old delivery equipment was purchased on January 1 2015 for $126000 and was estimated to have a $18000 salvage value at the end of its 5-year life. Depreciation on the delivery equipment has been recorded through December 31 2016. It is estimated that the fair value of the old delivery equipment is $54000 on September 30 2017.

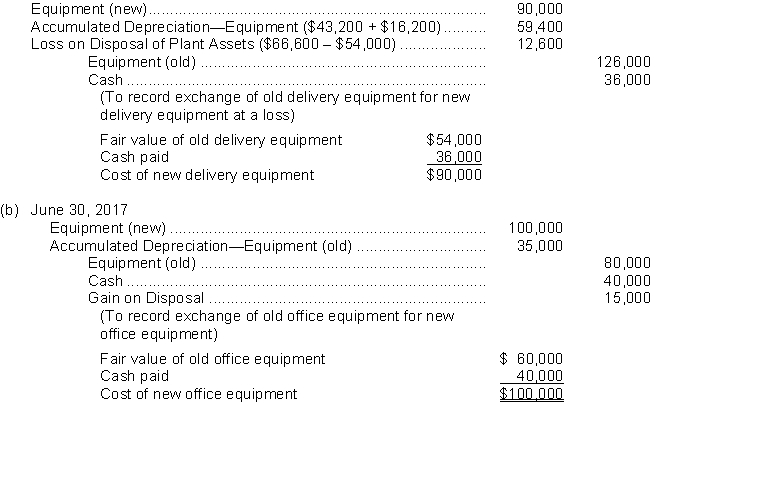

(b) On June 30 2017 the company exchanged old office equipment and $40000 for new office equipment. The old office equipment originally cost $80000 and had accumulated depreciation to the date of disposal of $35000. It is estimated that the fair market value of the old office equipment on June 30 was $60000. The transaction has commercial substance.

Straight-Line Depreciation

A method of allocating the cost of a tangible asset over its useful life in a linear fashion.

Delivery Equipment

Assets such as trucks and vans used by a company for the purpose of delivering products to customers.

Office Equipment

Tangible items used in an office environment for performing business operations, such as computers, printers, and furniture.

- Grasp the concepts and accounting treatments for plant asset transactions, including acquisition, depreciation, and disposal.

- Comprehend the process of exchanging plant assets and recognizing gains or losses.

Verified Answer

LC

Lindia CambridgeMay 12, 2024

Final Answer :

(a) September 30, 2017 Depreciation Expense16,200Accumulated Depreciation-Equipment. 16,200 (To record depreciation expense for the first 9 months\begin{array}{lrr} \text { September 30, 2017 } &\\ \text { Depreciation Expense} &16,200\\ \text {Accumulated Depreciation-Equipment. } &&16,200\\ \text { (To record depreciation expense for the first 9 months} &\end{array} September 30, 2017 Depreciation ExpenseAccumulated Depreciation-Equipment. (To record depreciation expense for the first 9 months16,20016,200

of 2017. $108000 ÷ 5 years = $21600 × 9/12 = $16200)

of 2017. $108000 ÷ 5 years = $21600 × 9/12 = $16200)

Learning Objectives

- Grasp the concepts and accounting treatments for plant asset transactions, including acquisition, depreciation, and disposal.

- Comprehend the process of exchanging plant assets and recognizing gains or losses.

Related questions

276 Dolan Company Exchanges Equipment with Eaton Company and Pawnee ...

If the Proceeds from the Sale of a Plant Asset ...

Bell Company and Kene Company Exchanged Trucks on January 1 ...

If Fully Depreciated Equipment That Cost $10000 with No Salvage ...

A Loss on the Exchange of Plant Assets Occurs When ...