Asked by Alyssa Sweeting on Jun 24, 2024

Verified

Pine Publishing Corporation uses a predetermined overhead rate based on direct labor-hours to apply manufacturing overhead to jobs.At the beginning of the year the Corporation estimated its total manufacturing overhead cost at $500,000 and its direct labor-hours at 125,000 hours.The actual overhead cost incurred during the year was $450,000 and the actual direct labor-hours incurred on jobs during the year was 115,000 hours.The manufacturing overhead for the year would be:

A) $10,000 underapplied.

B) $10,000 overapplied.

C) $50,000 underapplied.

D) $50,000 overapplied.

Predetermined Overhead Rate

A rate used to allocate estimated manufacturing overhead costs to individual units of production, based on a particular activity base.

Direct Labor-Hours

The totality of hours devoted by workers directly engaged in the fabrication of products.

Manufacturing Overhead

All indirect costs associated with the manufacturing process, including utilities, rent, and salaries for non-direct labor, that are not directly traceable to specific units produced.

- Understand the calculation and application of manufacturing overhead.

- Learn the calculation of the predetermined overhead rate based on direct labor-hours or machine-hours.

Verified Answer

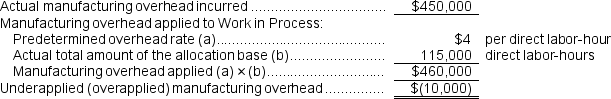

Predetermined overhead rate = Estimated total manufacturing overhead cost / Estimated direct labor-hours

= $500,000 / 125,000 hours

= $4 per direct labor-hour

Using this rate, we can calculate the total overhead applied to jobs as follows:

Total overhead applied = Predetermined overhead rate x Actual direct labor-hours incurred on jobs

= $4 per hour x 115,000 hours

= $460,000

Since the actual overhead cost incurred during the year was $450,000, the overhead was overapplied by $10,000 ($460,000 - $450,000). Therefore, the answer is B.

Overhead over or underapplied

Learning Objectives

- Understand the calculation and application of manufacturing overhead.

- Learn the calculation of the predetermined overhead rate based on direct labor-hours or machine-hours.

Related questions

Darrow Corporation Uses a Predetermined Overhead Rate Based on Direct ...

Karvel Corporation Uses a Predetermined Overhead Rate Based on Machine-Hours ...

The Estimated Total Manufacturing Overhead Is Closest To

The Estimated Total Manufacturing Overhead Is Closest To

Leisure Life Manufactures a Variety of Sporting Equipment ...