Asked by Aqualaquisha Lebron on Jun 04, 2024

Verified

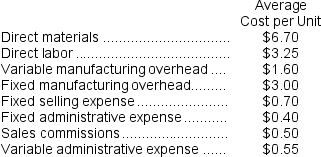

Perteet Corporation's relevant range of activity is 3,000 units to 7,000 units.When it produces and sells 5,000 units, its average costs per unit are as follows:  If 4,000 units are produced, the total amount of manufacturing overhead cost is closest to:

If 4,000 units are produced, the total amount of manufacturing overhead cost is closest to:

A) $18,100

B) $28,000

C) $21,400

D) $14,800

Manufacturing Overhead

Expenses related to the manufacturing process that are not directly tied to the production of goods, such as utility costs, maintenance, and factory rent.

Relevant Range

The range of activity within which the assumptions about variable and fixed cost behaviors are valid for a specific operation or business scenario.

Average Costs

The total cost of production divided by the total quantity produced, often used to determine profitability at various levels of output.

- Scrutinize the impact of differing activity levels on cost and calculations on a per unit basis.

- Investigate the components and characteristics of manufacturing overhead.

Verified Answer

EH

Eunjin HwangJun 09, 2024

Final Answer :

C

Explanation :

We can estimate the manufacturing overhead cost by using the high-low method. Let's take the highest and lowest levels of activity within the relevant range:

When production and sales volume is 7,000 units:

Total cost = Total variable cost + Total fixed cost

Assuming variable cost per unit is the same as at 5,000 units:

Total variable cost = 7,000 units × $7 per unit = $49,000

Total cost - $49,000 - fixed cost

When production and sales volume is 3,000 units:

Total cost = Total variable cost + Total fixed cost

Assuming variable cost per unit is the same as at 5,000 units:

Total variable cost = 3,000 units × $7 per unit = $21,000

Total cost - $21,000 - fixed cost

Using this information, we can calculate the variable cost per unit:

Variable cost per unit = (Total cost at high activity level - Total cost at low activity level) / (High activity level - Low activity level)

Variable cost per unit = ($49,000 - $21,000) / (7,000 units - 3,000 units) = $7 per unit

Now, we can use the estimated variable cost per unit to calculate the total amount of manufacturing overhead cost at 4,000 units:

Variable cost at 4,000 units = 4,000 units x $7 per unit = $28,000

Total cost at 4,000 units = Total variable cost + Total fixed cost

$28,000 = $4,000 x $7 per unit + Total fixed cost

Total fixed cost = $28,000 - $28,000 = $0

Therefore, the total amount of manufacturing overhead cost at 4,000 units is closest to $21,400, which is option C.

When production and sales volume is 7,000 units:

Total cost = Total variable cost + Total fixed cost

Assuming variable cost per unit is the same as at 5,000 units:

Total variable cost = 7,000 units × $7 per unit = $49,000

Total cost - $49,000 - fixed cost

When production and sales volume is 3,000 units:

Total cost = Total variable cost + Total fixed cost

Assuming variable cost per unit is the same as at 5,000 units:

Total variable cost = 3,000 units × $7 per unit = $21,000

Total cost - $21,000 - fixed cost

Using this information, we can calculate the variable cost per unit:

Variable cost per unit = (Total cost at high activity level - Total cost at low activity level) / (High activity level - Low activity level)

Variable cost per unit = ($49,000 - $21,000) / (7,000 units - 3,000 units) = $7 per unit

Now, we can use the estimated variable cost per unit to calculate the total amount of manufacturing overhead cost at 4,000 units:

Variable cost at 4,000 units = 4,000 units x $7 per unit = $28,000

Total cost at 4,000 units = Total variable cost + Total fixed cost

$28,000 = $4,000 x $7 per unit + Total fixed cost

Total fixed cost = $28,000 - $28,000 = $0

Therefore, the total amount of manufacturing overhead cost at 4,000 units is closest to $21,400, which is option C.

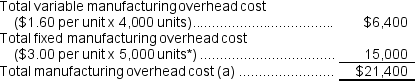

Explanation :  *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by 5,000 units.

*The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by 5,000 units.

*The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by 5,000 units.

*The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by 5,000 units.

Learning Objectives

- Scrutinize the impact of differing activity levels on cost and calculations on a per unit basis.

- Investigate the components and characteristics of manufacturing overhead.