Asked by Robert Brownlee Jr on May 05, 2024

Verified

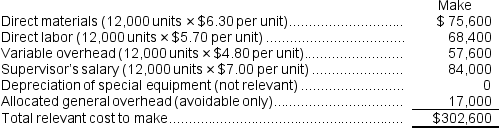

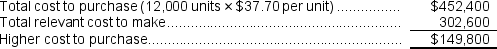

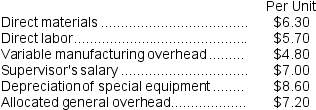

Part S51 is used in one of Haberkorn Corporation's products.The company makes 12,000 units of this part each year.The company's Accounting Department reports the following costs of producing the part at this level of activity:  An outside supplier has offered to produce this part and sell it to the company for $37.70 each.If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company.If the outside supplier's offer were accepted, only $17,000 of these allocated general overhead costs would be avoided. The annual financial advantage (disadvantage) for the company as a result of buying the part from the outside supplier would be:

An outside supplier has offered to produce this part and sell it to the company for $37.70 each.If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company.If the outside supplier's offer were accepted, only $17,000 of these allocated general overhead costs would be avoided. The annual financial advantage (disadvantage) for the company as a result of buying the part from the outside supplier would be:

A) ($5,800)

B) ($22,800)

C) ($149,800)

D) ($39,800)

Variable Costs

Expenses that fluctuate with changes in production output, such as raw materials, packaging, and labor directly involved in producing a product.

Allocated General Overhead

The portion of indirect costs that have been assigned to a specific product, department, or project.

Special Equipment

Custom or unique machinery or tools developed or acquired for specialized production or operational processes.

- Appreciate the financial ramifications of externalizing component production versus producing them within the company.

Verified Answer

Learning Objectives

- Appreciate the financial ramifications of externalizing component production versus producing them within the company.

Related questions

Supler Corporation Produces a Part Used in the Manufacture of ...

Do You Think the Decision to Outsource And/or Offshore Some ...

Moving Production from Outside a Country Back to the Home ...

For Small Volumes,the Cost to Manufacture In-House Will Be Lower ...

Each of the Following Is a Disadvantage of Buying Rather ...