Asked by Elisa Otero on Jul 04, 2024

Verified

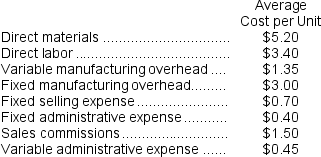

Parlavecchio Corporation's relevant range of activity is 2,000 units to 6,000 units.When it produces and sells 4,000 units, its average costs per unit are as follows:  Required:

Required:

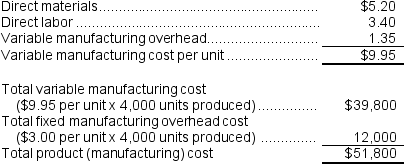

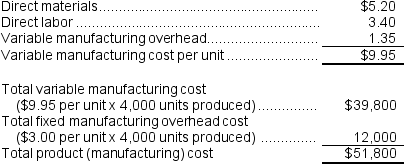

a.For financial reporting purposes, what is the total amount of product costs incurred to make 4,000 units?

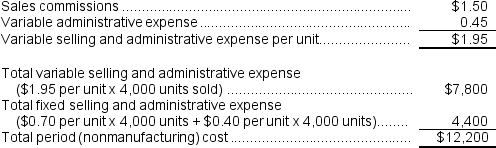

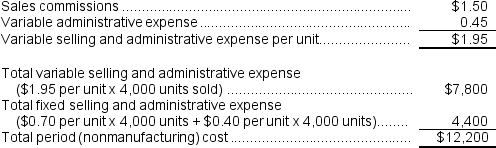

b.For financial reporting purposes, what is the total amount of period costs incurred to sell 4,000 units?

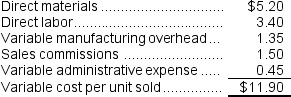

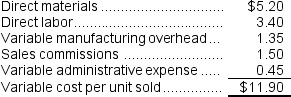

c.If 5,000 units are sold, what is the variable cost per unit sold?

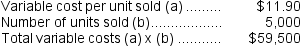

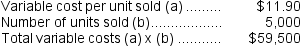

d.If 5,000 units are sold, what is the total amount of variable costs related to the units sold?

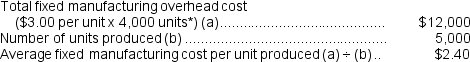

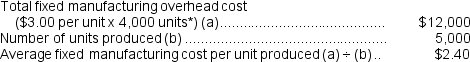

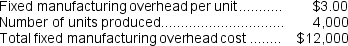

e.If 5,000 units are produced, what is the average fixed manufacturing cost per unit produced?

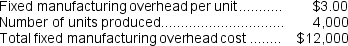

f.If 5,000 units are produced, what is the total amount of fixed manufacturing cost incurred?

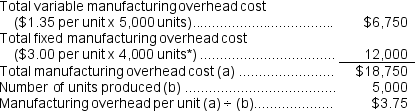

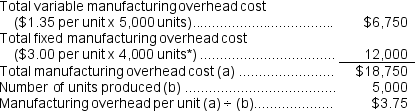

g.If 5,000 units are produced, what is the total amount of manufacturing overhead cost incurred? What is this total amount expressed on a per unit basis?

Product Costs

The costs directly attributed to the production of a product, including materials, labor, and manufacturing overhead.

Period Costs

Expenses that are not directly attached to product production and are accounted for in the period they are incurred, such as sales and administrative expenses.

Fixed Manufacturing Cost

Costs that do not change with the level of production, such as rent, salaries, and equipment depreciation.

- Learn the differences between product costs and period costs.

- Acquire knowledge on how to evaluate and compute the contribution margin.

- Realize the implications of shifts in production magnitude on the behavior of costs and expense trends.

Verified Answer

SG

Steph GonzagaJul 11, 2024

Final Answer :

a.  b.

b.  c.

c.  d.

d.  e.

e.  *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by 4,000 units.

*The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by 4,000 units.

f. g.

g.  *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by 4,000 units.

*The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by 4,000 units.

b.

b.  c.

c.  d.

d.  e.

e.  *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by 4,000 units.

*The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by 4,000 units.f.

g.

g.  *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by 4,000 units.

*The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by 4,000 units.

Learning Objectives

- Learn the differences between product costs and period costs.

- Acquire knowledge on how to evaluate and compute the contribution margin.

- Realize the implications of shifts in production magnitude on the behavior of costs and expense trends.