Asked by Michael Culham on Jun 14, 2024

Verified

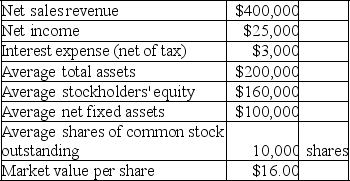

Packers Corporation reported the following data for the year ended December 31,2019:

Calculate each of the following ratios:

Calculate each of the following ratios:

A.Net profit margin

B.Return on assets

C.Return on equity

D.Earnings per share

E.Price/earnings ratio

F.Debt-to-equity ratio

G.Fixed asset turnover ratio

Net Profit Margin

A financial ratio representing the percentage of net income to sales revenue, indicating how much of each dollar earned by the company is translated into profits.

Return on Assets

A ratio indicating how efficiently a company is using its assets to generate profit, calculated as net income divided by total assets.

Earnings Per Share

A metric that divides a company's profit available to its common stockholders by the average outstanding shares.

- Analyze the financial health of corporations by examining ratios related to profitability, liquidity, and solvency.

- Assess and distinguish the fiscal well-being of corporations in a similar sector via thorough ratio examination.

Verified Answer

B.Return on assets = $25,000 ÷ $200,000 = 12.5%.

C.Return on equity = $25,000 ÷ $160,000 = 15.6%.

D.Earnings per share = $25,000 ÷ 10,000 shares = $2.50.

E.Price/earnings ratio = $16 ÷ $2.50 = 6.4.

F.Debt-to-equity ratio = ($200,000 - $160,000)÷ $160,000 = 25%.

G.Fixed asset turnover ratio = $400,000 ÷ $100,000 = 4 times.

Learning Objectives

- Analyze the financial health of corporations by examining ratios related to profitability, liquidity, and solvency.

- Assess and distinguish the fiscal well-being of corporations in a similar sector via thorough ratio examination.

Related questions

At the End of 2019,Doran Corporation Reported Net Income of ...

The Following Data Were Reported by Universe Company at Year-End ...

Compete Corporation Reported a Quick Ratio of 1 ...

The Following Items Are Reported on Denver Company's Balance Sheet ...

A Firm Has a Lower Inventory Turnover, a Longer ACP ...