Asked by Claudiadavid Murillo on Jul 04, 2024

Verified

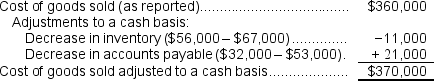

On the statement of cash flows, the cost of goods sold adjusted to a cash basis would be:

A) $360,000

B) $350,000

C) $370,000

D) $381,000

Cash Basis

An accounting method where revenues and expenses are recorded only when cash is received or paid, regardless of when the transactions occurred.

Cost of Goods Sold

The direct costs attributable to the production of the goods sold by a company, including the cost of the materials and labor used in creating the good.

- Evaluate the adjusted cost of goods sold on a cash basis through the direct method.

Verified Answer

Learning Objectives

- Evaluate the adjusted cost of goods sold on a cash basis through the direct method.

Related questions

Ellithorpe Corporation Has Provided the Following Data Concerning Last Month's ...

The Changes in Each Balance Sheet Account for Carver Corporation ...

Last Year, Knox Corporation Reported on Its Income Statement Sales ...

Weyant Corporation Has Provided the Following Data Concerning Last Month's ...

Cridberg Corporation's Selling and Administrative Expenses for Last Year Totaled ...