Asked by Sydnee Frakes on May 18, 2024

Verified

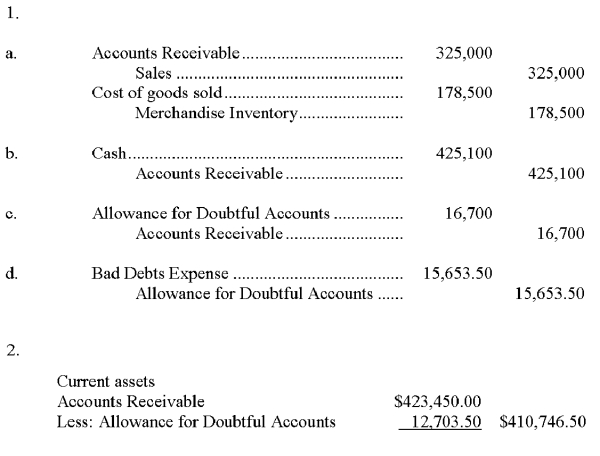

On September 30, Emerson Co. has $540,250 of accounts receivable. Emerson uses the allowance method of accounting for bad debts and has an existing credit balance in the allowance for doubtful accounts of $13,750. 1. Prepare journal entries to record the following selected October transactions. The company uses the perpetual inventory system. 2. Show how Accounts Receivable and the Allowance for Doubtful Accounts appear on its October 31 balance sheet.

a. Sold $325,000 of merchandise (that cost $178,500) to customers on credit.

b. Received $425,100 cash in payment of accounts receivable.

c. Wrote off $16,700 of uncollectible accounts receivable.

d. In adjusting the accounts on October 31, its fiscal year-end, the company estimated that 3.0% of accounts receivable will be uncollectible.

Allowance for Doubtful Accounts

A contra-asset account used to estimate the portion of accounts receivable that may not be collectible.

- Construct ledger entries to document transactions that include sales with credit conditions, sales through credit cards, and the management of uncollectible accounts receivable.

- Estimate and adjust the allowance for doubtful accounts based on receivables analysis.

Verified Answer

MH

Learning Objectives

- Construct ledger entries to document transactions that include sales with credit conditions, sales through credit cards, and the management of uncollectible accounts receivable.

- Estimate and adjust the allowance for doubtful accounts based on receivables analysis.

Related questions

MacKenzie Company Sold $180 of Merchandise to a Customer Who ...

A Company Allows Its Customers to Use Bank Credit Cards ...

On May 31,a Company Had a Balance in Its Accounts ...

Mullis Company Sold Merchandise on Account to a Customer for ...

Gemstone Products Allows Customers to Use Bank Credit Cards to ...