Asked by Priya Puppala on Jun 24, 2024

Verified

On September 1, 20X7, Spike Limited decided to buy 100% of the outstanding shares of Volley Inc. for $1,200,000, paid for with the issuance of shares. Acquisition costs for the deal totaled $30,000: $20,000 related to the issue of the shares and the remaining amount for legal, valuation, and administrative costs. All of these costs were paid in cash. In addition Spike has agreed to pay an additional $250,000 if the revenues of Volley have a 5% growth over the next two years from the date of the acquisition. It has been determined that the fair value of this contingent consideration is $175,000.

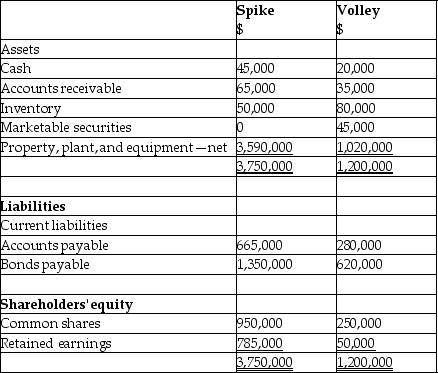

The balances showing on the statement of financial position for the two companies at August 31, 20X7, are as follows:

After a review of the financial assets and liabilities, Spike determines that some of the assets of Volley have fair values different from their carrying values. These items are listed below:

After a review of the financial assets and liabilities, Spike determines that some of the assets of Volley have fair values different from their carrying values. These items are listed below:

Property, plant, and equipment: fair value is $1,350,000

Patent: fair value is $255,000

Brand name: fair value is $135,000

Required:

Determine the amount of goodwill that will be recorded on the business combination.

Prepare the consolidated statement of financial position as at September 1, 20X7.

Outstanding Shares

Refers to the total number of shares of a corporation's stock that are owned by shareholders at any given time.

Acquisition Costs

Expenses directly associated with acquiring a new customer or asset, including marketing, sales expenses, and the cost of the goods or services themselves.

Contingent Consideration

An obligation of a buyer to transfer additional assets or equity interests to a seller if future events occur or conditions are met after a business combination.

- Compute the goodwill generated through a corporate merger.

- Analyze the impact of acquisition costs and contingent consideration on business combinations.

Verified Answer

Fair value of consideration:

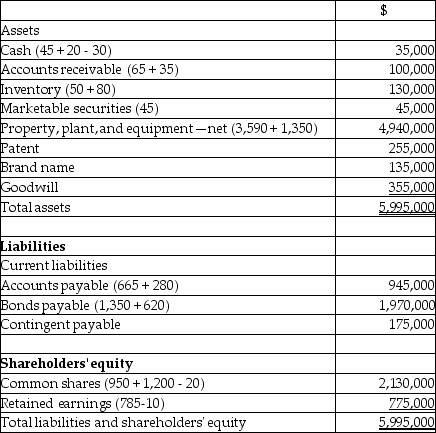

Issuance of shares $1,200,000 Contingent consideration 175,000‾ Total consideration paid or payable $1,375,000\begin{array}{ll}\text { Issuance of shares } & \$ 1,200,000 \\\text { Contingent consideration } & \underline{175,000} \\\text { Total consideration paid or payable } & \$ 1,375,000\end{array} Issuance of shares Contingent consideration Total consideration paid or payable $1,200,000175,000$1,375,000 The acquisition costs are not part of the acquisition. Instead, the costs to issue the shares of $20,000 are deducted from shares issued, and the other costs of $10,000 are expensed. Consideration received:

Fair value of net assets acquired:

Cash $20,000 Accounts receivable 35,000 Inventories 80,000 Marketable securities 45,000 Property, plant, and equipment 1,350,000 Patent 255,000 Band name 135,000 Current liabilities (280,000) Long-term liabilities (620,000)‾1,020,000 Goodwill $355,000\begin{array}{ll}\text { Cash } & \$ 20,000 \\\text { Accounts receivable } & 35,000 \\\text { Inventories } & 80,000 \\\text { Marketable securities } & 45,000 \\\text { Property, plant, and equipment } & 1,350,000 \\\text { Patent } & 255,000 \\\text { Band name } & 135,000 \\\text { Current liabilities } & (280,000) \\\text { Long-term liabilities } & \underline{(620,000)}&1,020,000\\\text { Goodwill }&&\$355,000\\\end{array} Cash Accounts receivable Inventories Marketable securities Property, plant, and equipment Patent Band name Current liabilities Long-term liabilities Goodwill $20,00035,00080,00045,0001,350,000255,000135,000(280,000)(620,000)1,020,000$355,000 Spike Limited

Consolidated Statement of Financial Position September 1,20X7 1,20X7 1,20X7

Learning Objectives

- Compute the goodwill generated through a corporate merger.

- Analyze the impact of acquisition costs and contingent consideration on business combinations.

Related questions

Cheers Acquired 100% of Tapp's Shares for $144,000 ...

MAX Inc Purchased 80% of the Voting Shares of MIN ...

The Collins Company Paid $1,050,000 to Purchase 70% of Revsine ...

On January 2,2015,the Rambler Company Purchased 40% of the Outstanding ...

Sonic Enterprises Inc Has Decided to Purchase 100% of the ...