Asked by Chrisitna Giosso on Jul 28, 2024

Verified

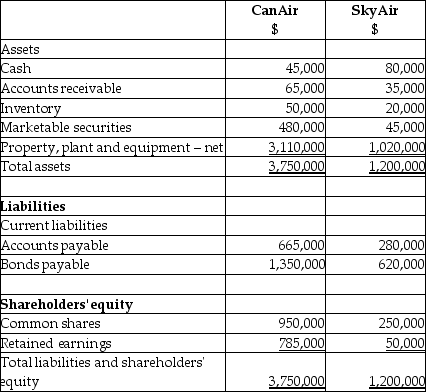

On September 1, 20X7, CanAir Limited decided to buy 100% of the shares outstanding of SkyAir Inc. for $1,215,000. CanAir will pay for this acquisition by cashing in all of its marketable securities and issuing share capital for the remaining amount. The balances showing on the statement of financial position for the two companies at August 31, 20X7, are as follows:

After a review of the financial assets and liabilities, CanAir determines that some of the assets of SkyAir have fair values different from their carrying values. These items are listed below:

After a review of the financial assets and liabilities, CanAir determines that some of the assets of SkyAir have fair values different from their carrying values. These items are listed below:

Property, plant, and equipment: Fair value is $1,350,000

Internet domain name: Fair value is $55,000

Customer lists: Fair value is $35,000

In addition, SkyAir has tax losses available for carryforward that have a fair value of $225,000 and it is probable that they will be realized in the future.

Required:

Determine the amount of goodwill that will be recorded on the business combination.

Prepare the consolidated statement of financial position as at September 1, 20X7.

Marketable Securities

These are liquid financial instruments that can be quickly converted into cash at market value, such as stocks, bonds, or Treasury bills.

Share Capital

The amount of money raised by a company through the issuance of shares to its shareholders, representing ownership in the company.

Customer Lists

An intangible asset representing the information about customers that a business has compiled, which can have value in marketing or sales efforts.

- Comprehend the procedures and arithmetic required to document goodwill during a takeover.

- Assess and analyze the monetary influence of mergers and acquisitions on the consolidated financial reports.

- Comprehend how adjustments based on fair value are handled within the context of acquisition accounting.

Verified Answer

SK

Sandeep KaredlaJul 29, 2024

Final Answer :

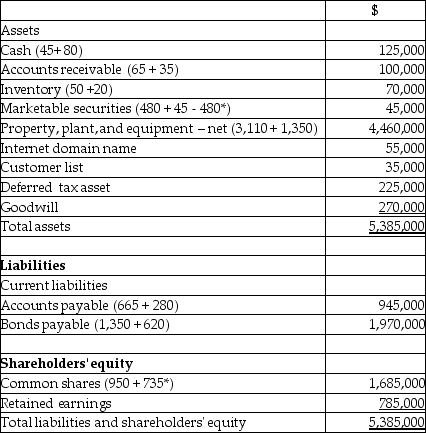

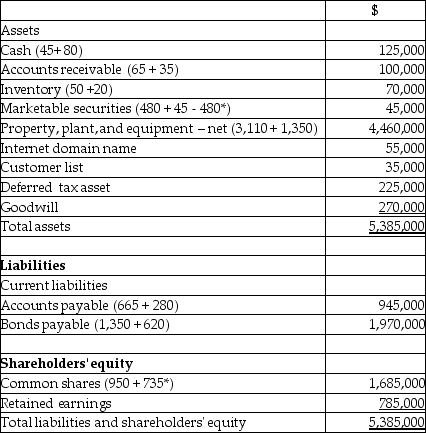

Calculation of goodwill:

Fair value of consideration paid $1,215,000\begin{array}{ll} \text { Fair value of consideration paid } &\$ 1,215,000\\\end{array} Fair value of consideration paid $1,215,000

Consideration received:

Fair value of net assets acquired:

Cash $80,000 Accounts receivable 35,000 Inventories 20,000 Marketable securities 45,000 Capital assets 1,350,000 Internet domain name 55,000 Custcaner lists 35,000 Deferred tax assets 225,000 Current liabilities (280,000) Long-tem liabilities (620,000)‾945,000‾ Coodwill $270,000‾\begin{array}{lll}\text { Cash } & \$ 80,000 \\\text { Accounts receivable } & 35,000 \\\text { Inventories } & 20,000 \\\text { Marketable securities } & 45,000 \\\text { Capital assets } & 1,350,000 \\\text { Internet domain name } & 55,000 \\\text { Custcaner lists } & 35,000 \\\text { Deferred tax assets } & 225,000 \\\text { Current liabilities } & ( 280,000 ) \\\text { Long-tem liabilities } & \underline{( 620,000 )}& \underline{945,000}\\\text { Coodwill }&& \underline{\$270,000}\end{array} Cash Accounts receivable Inventories Marketable securities Capital assets Internet domain name Custcaner lists Deferred tax assets Current liabilities Long-tem liabilities Coodwill $80,00035,00020,00045,0001,350,00055,00035,000225,000(280,000)(620,000)945,000$270,000 Can Air Limited

Consolidated Statement of Financial Position

September 1, 20X 7

*Note: The purchase price of $1,215,000 is paid with cash from the marketable securities of $480,000 and an issue of shares totalling $735,000.

*Note: The purchase price of $1,215,000 is paid with cash from the marketable securities of $480,000 and an issue of shares totalling $735,000.

Fair value of consideration paid $1,215,000\begin{array}{ll} \text { Fair value of consideration paid } &\$ 1,215,000\\\end{array} Fair value of consideration paid $1,215,000

Consideration received:

Fair value of net assets acquired:

Cash $80,000 Accounts receivable 35,000 Inventories 20,000 Marketable securities 45,000 Capital assets 1,350,000 Internet domain name 55,000 Custcaner lists 35,000 Deferred tax assets 225,000 Current liabilities (280,000) Long-tem liabilities (620,000)‾945,000‾ Coodwill $270,000‾\begin{array}{lll}\text { Cash } & \$ 80,000 \\\text { Accounts receivable } & 35,000 \\\text { Inventories } & 20,000 \\\text { Marketable securities } & 45,000 \\\text { Capital assets } & 1,350,000 \\\text { Internet domain name } & 55,000 \\\text { Custcaner lists } & 35,000 \\\text { Deferred tax assets } & 225,000 \\\text { Current liabilities } & ( 280,000 ) \\\text { Long-tem liabilities } & \underline{( 620,000 )}& \underline{945,000}\\\text { Coodwill }&& \underline{\$270,000}\end{array} Cash Accounts receivable Inventories Marketable securities Capital assets Internet domain name Custcaner lists Deferred tax assets Current liabilities Long-tem liabilities Coodwill $80,00035,00020,00045,0001,350,00055,00035,000225,000(280,000)(620,000)945,000$270,000 Can Air Limited

Consolidated Statement of Financial Position

September 1, 20X 7

*Note: The purchase price of $1,215,000 is paid with cash from the marketable securities of $480,000 and an issue of shares totalling $735,000.

*Note: The purchase price of $1,215,000 is paid with cash from the marketable securities of $480,000 and an issue of shares totalling $735,000.

Learning Objectives

- Comprehend the procedures and arithmetic required to document goodwill during a takeover.

- Assess and analyze the monetary influence of mergers and acquisitions on the consolidated financial reports.

- Comprehend how adjustments based on fair value are handled within the context of acquisition accounting.