Asked by Katie Moules on May 04, 2024

Verified

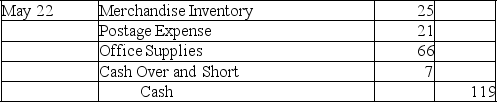

On May 1,a company established a $125 petty cash fund.On May 22,the petty cash fund contains $6 in cash and the following paid petty cash receipts: transportation-in on merchandise inventory $25; postage,$21; and office supplies,$66.Record the general journal entry to reimburse the fund.

Petty Cash Receipts

Petty cash receipts are documents that record small, immediate cash expenses incurred by a business, tracking the disbursement and replenishment of a petty cash fund.

Reimburse

To pay back money to someone which they have spent or lost.

Transportation-In

Costs associated with bringing raw materials to a manufacturing plant or storage location, typically classified as part of the inventory cost on the balance sheet.

- Acknowledge the value of a petty cash system and its administration.

Verified Answer

Learning Objectives

- Acknowledge the value of a petty cash system and its administration.

Related questions

The Petty Cash Fund Eliminates the Need for a Bank ...

In Establishing a Petty Cash Fund, a Check Is Written ...

Expenditures from a Petty Cash Fund Are Documented by a ...

Bonkowski Corporation Makes One Product and Has Provided the Following ...

The Cash Manager's Goal Is to Minimize the Firm's Cash ...