Asked by Iqbal Qayum on May 27, 2024

Verified

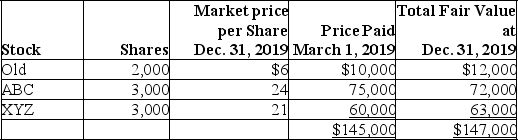

On March 1,2019,Young Company paid cash to purchase the following stocks as long-term investments:

Old Corporation common stock (par $5),2,000 shares at $5 per share (10% of outstanding shares)

ABC Corporation common stock (par $10),3,000 shares at $25 per share (15% of outstanding shares)

XYZ Corporation common stock (par $10),3,000 shares at $20 per share (10% of outstanding shares)

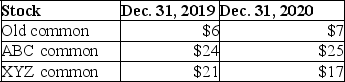

The market prices per share at December 31,end of the accounting period,were as follows:

Prepare the required journal entries at the following dates: March 1,2019,December 31,2019 and December 31,2020.

Prepare the required journal entries at the following dates: March 1,2019,December 31,2019 and December 31,2020.

Long-Term Investments

Assets held by a company for a period exceeding one year, intended to bring a return on the investment over time.

Common Stock

Equity securities that represent ownership in a corporation, giving holders voting rights and a share in the company's profits via dividends.

Accounting Period

A specific time frame in which financial transactions are recorded and financial statements are prepared, commonly a fiscal quarter or year.

- Distinguish between different types of securities and their accounting treatments.

- Prepare the necessary journal entries for the acquisition and sale of securities.

Verified Answer

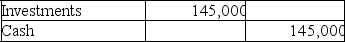

(2,000 × $5)+ (3,000 × $25)+ (3,000 × $20)= $145,000

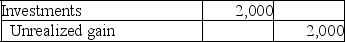

(2,000 × $5)+ (3,000 × $25)+ (3,000 × $20)= $145,000December 31,2019:

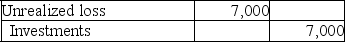

December 31,2020:

December 31,2020:

Learning Objectives

- Distinguish between different types of securities and their accounting treatments.

- Prepare the necessary journal entries for the acquisition and sale of securities.

Related questions

As a Long-Term Investment,Martha Company Purchased 5,000 of the 12,500 ...

On January 31,2018,McBurger Corporation Purchased the Following Shares of Voting ...

Once a Company Decides to Use the Fair Value Option ...

Minority Passive Investments of Less Than 20% of the Voting ...

Unrealized Gains and Losses on Available-For-Sale Securities Are Reported as ...