Asked by Victoria Konko on May 10, 2024

Verified

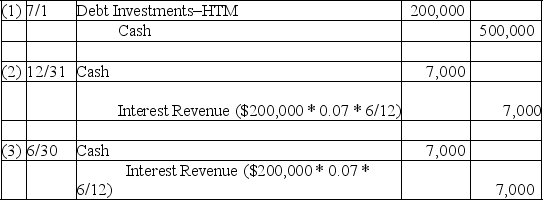

On July 1 of the current year,a company paid $200,000 to purchase 7%,10-year bonds with a par value of $200,000; interest is paid semiannually on June 30 and December 31.The company intends to hold the bonds until they mature.Prepare the journal entries to record (1)the bond purchase,(2)the receipt of the first semiannual interest payment on December 31 of the current year,and (3)the receipt of the second semiannual payment on June 30.

Semiannual Interest Payment

A finance term referring to the practice of making interest payments twice a year on a loan or bond.

Bonds

Debt instruments signifying an investment made by an investor in the form of a loan to either a corporation or a government entity.

Journal Entries

Records of financial transactions in the books of accounts, acting as the primary source for all accounting processes.

- Identify the differences in classifications for debt investments and their specific accounting procedures.

Verified Answer

Learning Objectives

- Identify the differences in classifications for debt investments and their specific accounting procedures.

Related questions

The Market Price That Would Be Received If an Investment ...

Investments in Trading Securities Are Always Classified as ________ and ...

Long-Term Investments in Held-To-Maturity Debt Securities Are Accounted for Using ...

When One Company Owns More Than 50% of Another Company's ...

On January 31,2018,McBurger Corporation Purchased the Following Shares of Voting ...