Asked by Kennedy Kaiser on Jun 10, 2024

Verified

On July 1, 2021, Carbondale City ordered $1,800 of office supplies. They were to be paid for out of the general fund.Required:(A) What journal entry was required for the governmental fund financial statements?(B) What journal entry was required for the government-wide financial statements?

General Fund

The main operating fund of a government, covering general expenses not accounted for by specific funds.

Government-Wide Financial Statements

Comprehensive financial reports that display the financial condition of a government entity as a whole, as opposed to focusing on individual funds or accounts.

- Understand the methodology and perform the recording of transactions in governmental and enterprise funds through journal entries.

- Differentiate between categories of fund financial statements and financial statements that apply to the entire government.

Verified Answer

AB

Anisa BordayoJun 13, 2024

Final Answer :

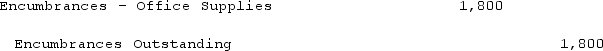

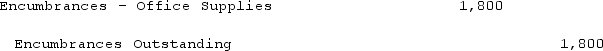

(A) For the governmental fund financial statements, an encumbrance must be recorded in the general fund.  (B) For the government-wide financial statements, no entry is required because under accrual accounting, no entry is made until a transaction occurs.

(B) For the government-wide financial statements, no entry is required because under accrual accounting, no entry is made until a transaction occurs.

(B) For the government-wide financial statements, no entry is required because under accrual accounting, no entry is made until a transaction occurs.

(B) For the government-wide financial statements, no entry is required because under accrual accounting, no entry is made until a transaction occurs.

Learning Objectives

- Understand the methodology and perform the recording of transactions in governmental and enterprise funds through journal entries.

- Differentiate between categories of fund financial statements and financial statements that apply to the entire government.

Related questions

On June 14, 2021, Carbondale City Agreed to Transfer Cash ...

How Do Intra-Activity and Interactivity Transactions Differ in Government-Wide Financial ...

On August 21, 2021, Carbondale City Transferred $150,000 from One ...

A New Truck Was Ordered for the Sanitation Department at ...

Which of the Financial Statements Recognizes Only Transactions in Which ...