Asked by Beatrice Sarah Jacob on May 29, 2024

Verified

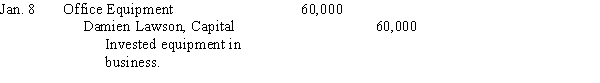

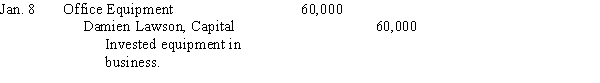

On January 8, Damien Lawson transfers ownership of several pieces of office equipment to his new business, JumpStart. When new, these items were worth $72,500. The fair market value of the equipment is $60,000. Journalize this transfer.

Journalize

The act of recording transactions in the journal as part of the accounting process.

Office Equipment

Tangible property like desks, computers, and machinery used in an office for operations.

Fair Market Value

The price at which an asset would change hands between a willing buyer and seller, both having reasonable knowledge of the relevant facts and neither being under any compulsion to buy or sell.

- Record fundamental accounting transactions related to acquisitions, dispositions, and disbursements.

Verified Answer

ZK

Zybrea KnightJun 02, 2024

Final Answer :

While Damien may have paid $72,500 for this equipment sometime in the past, it should be transferred into the company at fair market value

While Damien may have paid $72,500 for this equipment sometime in the past, it should be transferred into the company at fair market value

(FMV), $60,000.

While Damien may have paid $72,500 for this equipment sometime in the past, it should be transferred into the company at fair market value

While Damien may have paid $72,500 for this equipment sometime in the past, it should be transferred into the company at fair market value (FMV), $60,000.

Learning Objectives

- Record fundamental accounting transactions related to acquisitions, dispositions, and disbursements.