Asked by Llaneth Valenzuela on Jun 10, 2024

Verified

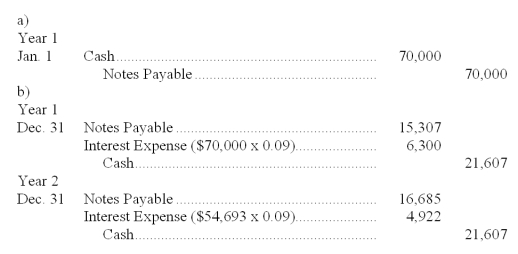

On January 1, Year 1 a company borrowed $70,000 cash by signing a 9% installment note that is to be repaid with 4 annual year-end payments of $21,607, the first of which is due on December 31, Year 1.

(a) Prepare the company's journal entry to record the note's issuance.

(b) Prepare the journal entries to record the first and second installment payments.

Year-End Payments

Financial obligations that are due or paid at the end of the fiscal year, such as bonuses or tax liabilities.

- Comprehend the procedures for recording bond issuance, installment payments, and amortization entries in journal entries.

Verified Answer

CM

Learning Objectives

- Comprehend the procedures for recording bond issuance, installment payments, and amortization entries in journal entries.

Related questions

A Corporation Borrowed $125,000 Cash by Signing a 5-Year,9% Installment ...

On July 1,Shady Creek Resort Borrowed $250,000 Cash by Signing ...

The Journal Entry to Record the Issuance of the Bond ...

Accrued Interest on Bonds Which Sold Above Face Value ...

Presented Below Are Three Independent Situations ...