Asked by Elaine Burnside on Jul 04, 2024

Verified

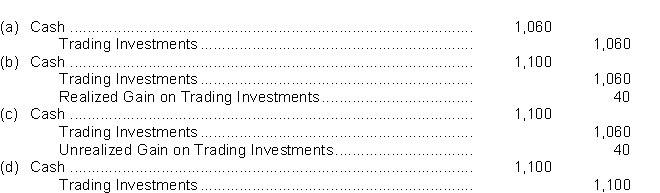

On January 1, Saskatoon Corporation purchased as a trading investment a $1,000, 6% bond for $1,060.The bond pays interest on January 1 and July 1.After receiving and recording the interest, the bond is sold on July 1 for $1,100.What is the entry to record the cash proceeds at the time the bond is sold?

Trading Investment

An investment in securities with the intention of selling them in the short term to profit from price changes.

Interest

The cost of borrowing money, usually expressed as a percentage of the amount borrowed, paid by the borrower to the lender.

- Ascertain and record unrealized earnings and deficits for investments intended for trading uses.

Verified Answer

ZK

Learning Objectives

- Ascertain and record unrealized earnings and deficits for investments intended for trading uses.

Related questions

Yoga Copurchased 15% of Glow Company's Outstanding Bonds During 2019 ...

Assume That the Roy Company Stock Was Sold During 2017 ...

An Investor Purchased 500 Shares of Common Stock, $25 Par ...

On January 1, the Valuation Allowance for Trading Investments Account ...

Posthorn Corporation Acquired 20,000 of the 100,000 Outstanding Common Shares ...