Asked by Sarah Dinek on Apr 25, 2024

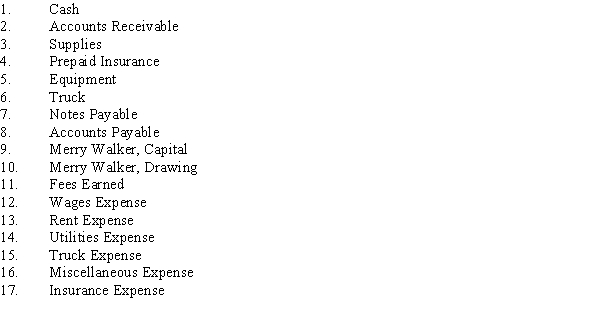

On January 1, Merry Walker established a catering service. Listed below are accounts to use for transactions

(a) through

(f), each identified by a number. Following this list are the transactions that occurred in Walker's first month of operations. You are to indicate for each transaction the accounts that should be debited and credited by placing the account number

(s) in the appropriate box.  Transactions Account(s) Debited Account(s) Credited a. Recorded jobs completed on account and sent invoices to customers. b. Received an invoice for truck expenses to be paid in February. c. Paid utilities expense ac Received cash from customers on account. e. Paid employee wages. f. Withdrew cash for personal use. \begin{array} { | l | l | l | } \hline \text { Transactions } & \text { Account(s) Debited } & \text { Account(s) Credited } \\\hline \text { a. Recorded jobs completed on } & & \\\text { account and sent invoices to } & & \\\text { customers. } & & \\\hline \text { b. Received an invoice for truck } & & \\\text { expenses to be paid in February. } & & \\\hline \text { c. Paid utilities expense } & & \\\hline \begin{array} { l } \text { ac Received cash from customers on } \\\text { account. }\end{array} & & \\\hline \text { e. Paid employee wages. } & & \\\hline \text { f. Withdrew cash for personal use. } & & \\\hline\end{array} Transactions a. Recorded jobs completed on account and sent invoices to customers. b. Received an invoice for truck expenses to be paid in February. c. Paid utilities expense ac Received cash from customers on account. e. Paid employee wages. f. Withdrew cash for personal use. Account(s) Debited Account(s) Credited

Transactions Account(s) Debited Account(s) Credited a. Recorded jobs completed on account and sent invoices to customers. b. Received an invoice for truck expenses to be paid in February. c. Paid utilities expense ac Received cash from customers on account. e. Paid employee wages. f. Withdrew cash for personal use. \begin{array} { | l | l | l | } \hline \text { Transactions } & \text { Account(s) Debited } & \text { Account(s) Credited } \\\hline \text { a. Recorded jobs completed on } & & \\\text { account and sent invoices to } & & \\\text { customers. } & & \\\hline \text { b. Received an invoice for truck } & & \\\text { expenses to be paid in February. } & & \\\hline \text { c. Paid utilities expense } & & \\\hline \begin{array} { l } \text { ac Received cash from customers on } \\\text { account. }\end{array} & & \\\hline \text { e. Paid employee wages. } & & \\\hline \text { f. Withdrew cash for personal use. } & & \\\hline\end{array} Transactions a. Recorded jobs completed on account and sent invoices to customers. b. Received an invoice for truck expenses to be paid in February. c. Paid utilities expense ac Received cash from customers on account. e. Paid employee wages. f. Withdrew cash for personal use. Account(s) Debited Account(s) Credited

Accounts Debited

Accounts that are increased with a debit entry, typically including assets and expenses.

- Correctly identify accounts to be debited and credited in given transactions.

Learning Objectives

- Correctly identify accounts to be debited and credited in given transactions.