Asked by Kenrick Mendez on Jun 23, 2024

Verified

On January 1,2019,Mission Company agreed to buy some equipment from Anna Company.Mission Company signed a non-interest-bearing note,agreeing to pay Anna Company the entire $500,000 for the equipment on December 31,2021.The market rate of interest for this note was 10%.

(Round all answers to whole dollar amounts. )

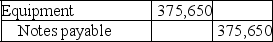

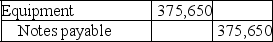

A.Prepare the journal entry Mission Company would record on January 1,2019 related to this purchase.

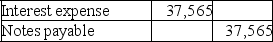

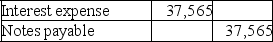

B.Prepare the December 31,2019,adjusting entry to record interest expense related to the note for the first year.Assume that no adjusting entries have been made during the year.

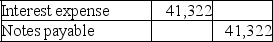

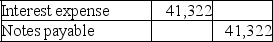

C.Prepare the December 31,2020,adjusting entry to record interest expense related to the note for the second year.Assume that no adjusting entries have been made during the year.

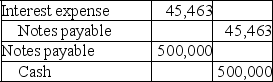

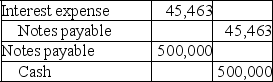

D.Prepare the entry Mission Company would record on December 31,2021,the due date of the note to record interest expense for the third year and payment of the note.Assume that no adjusting entries have been made during the year.Round the interest expense to an amount that will increase notes payable to the correct final payoff amount.

Non-Interest-Bearing Note

A debt instrument that does not accrue interest over its life, meaning it is issued at its face value and repaid at the same amount without additional interest payments.

Market Rate

The prevailing interest rate available in the marketplace for loans and deposits, influenced by supply and demand, the central bank’s policy, and other factors.

Interest Expense

An accounting item representing the charge for the use of borrowed funds, affecting an organization's net income.

- Grasp the concepts of non-interest-bearing notes and the accrual of interest expense over time.

Verified Answer

PT

phakamani tshabanguJun 27, 2024

Final Answer :

A.

$500,000 × 0.7513 (present value of $1,10%,3 periods)= $375,650.

$500,000 × 0.7513 (present value of $1,10%,3 periods)= $375,650.

B.

$375,650 × .10 = $37,565.

$375,650 × .10 = $37,565.

C.

$375,650 + $37,565 = $413,215

$375,650 + $37,565 = $413,215

$413,215 × 10% = $41,322

D.

($375,650 + $37,565 + $41,322)= $454,537

($375,650 + $37,565 + $41,322)= $454,537

$454,537 × .10 = $45,454 (Rounding required $9;you must use $45,463 in order to leave notes payable with a zero balance. )

$500,000 × 0.7513 (present value of $1,10%,3 periods)= $375,650.

$500,000 × 0.7513 (present value of $1,10%,3 periods)= $375,650.B.

$375,650 × .10 = $37,565.

$375,650 × .10 = $37,565.C.

$375,650 + $37,565 = $413,215

$375,650 + $37,565 = $413,215$413,215 × 10% = $41,322

D.

($375,650 + $37,565 + $41,322)= $454,537

($375,650 + $37,565 + $41,322)= $454,537$454,537 × .10 = $45,454 (Rounding required $9;you must use $45,463 in order to leave notes payable with a zero balance. )

Learning Objectives

- Grasp the concepts of non-interest-bearing notes and the accrual of interest expense over time.