Asked by Megan Beadle on Jul 26, 2024

Verified

On January 1, 2010, a creditor has a $200, 000 note receivable with an impaired value of $178, 571.43.The contract interest rate is 12%, and the current market rate is 10%.The principal is due on December 31, 2013.Interest payments will only be made on December 31 of 2011, 2012, and 2013.

Required:

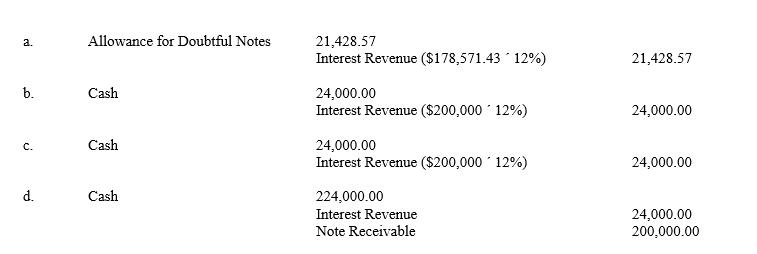

a. Prepare the journal entry to record the 2010 interest revenue.

b. Prepare the journal entry to record the 2011 interest revenue and cash received.

c. Prepare the joumal entry to record the 2012 interest revenue and cash received.

d. Prepare the journal entry to record receipt of the final interest and principal.

Note Receivable

A written promise for amounts to be received by a business, typically including interest, from another party.

Impaired Value

The condition in which the market value of an asset is less than its carrying value on the balance sheet.

Interest Revenue

Income earned by an entity through lending funds or depositing funds in interest-bearing accounts.

- Understand the fundamentals of bonds issuance and the impact of different interest rates (contract vs. market) on bond prices.

- Develop the skill to log and relay various bond transaction types, including but not limited to, their issuance, the calculation of interest expenses, amortization of discounts or premiums, and final redemption.

Verified Answer

MR

Learning Objectives

- Understand the fundamentals of bonds issuance and the impact of different interest rates (contract vs. market) on bond prices.

- Develop the skill to log and relay various bond transaction types, including but not limited to, their issuance, the calculation of interest expenses, amortization of discounts or premiums, and final redemption.