Asked by Mckennzie Kearns on Jun 07, 2024

Verified

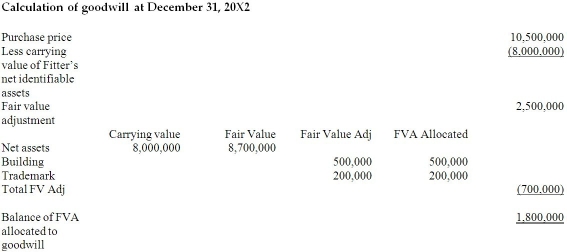

On December 31, 20X2, Pipe Ltd. purchased 100% of the outstanding common shares of Fitter Ltd. for $10.5 million in cash. On that date, the shareholders' equity of Fitter totalled $8 million and consisted of $1 million in no par common shares and $7 million in retained earnings. Both companies use the straight-line method to calculate depreciation and amortization. Goodwill, if any arises as a result of this business combination, is written down if there is an impairment in its value. Pipe follows IFRS.

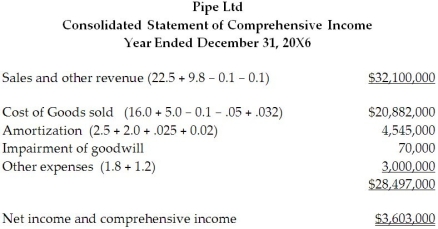

For the year ending December 31, 20X6, the income statements for Pipe and Fitter were as follows:

Pipe Fitter Sales and other revenue $22,500,000‾$9,800,000‾ Cost of goods sold 16,000,0005,000,000 Depreciation expense 2,500,0002,000,000 Other expenses 1,800,000‾1,200,000‾ Total expenses 20,300,000‾8,200,000‾Net income$2,200,000‾1,600,000‾\begin{array}{lll}&\text {Pipe }&\text {Fitter}\\\text { Sales and other revenue } & \underline{\$ 22,500,000 }& \underline{\$ 9,800,000} \\\text { Cost of goods sold } & 16,000,000 & 5,000,000 \\\text { Depreciation expense } & 2,500,000 & 2,000,000 \\\text { Other expenses } & \underline{1,800,000} & \underline{1,200,000} \\\text { Total expenses } & \underline{20,300,000} & \underline{8,200,000} \\\text {Net income}& \underline{\$ 2,200,000 }& \underline{1,600,000}\end{array} Sales and other revenue Cost of goods sold Depreciation expense Other expenses Total expenses Net incomePipe $22,500,00016,000,0002,500,0001,800,00020,300,000$2,200,000Fitter$9,800,0005,000,0002,000,0001,200,0008,200,0001,600,000 At December 31, 20X6, the condensed balance sheets for the two companies were as follows:

Pipe Fitter Total assets $31,000,000‾$13,500,000‾\begin{array} { l l l } & \text { Pipe } & \text { Fitter } \\\text { Total assets } &\underline{ \$ 31,000,000 }& \underline{\$ 13,500,000}\end{array} Total assets Pipe $31,000,000 Fitter $13,500,000 Liabilities $5,000,000$1,200,000 No par common stock 12,100,0001,000,000 Retained earnings 13,900,000‾11,300,000‾ Total liabilities andshareholders’ equity $31,000,000‾$13,500,000‾\begin{array} { l l l } \text { Liabilities } & \$ 5,000,000 & \$ 1,200,000 \\\text { No par common stock } & 12,100,000 & 1,000,000 \\\text { Retained earnings } & \underline { 13,900,000 } & \underline { 11,300,000 } \\\text { Total liabilities andshareholders' equity } & \underline { \$ 31,000,000} & \underline { \$ 13,500,000}\end{array} Liabilities No par common stock Retained earnings Total liabilities andshareholders’ equity $5,000,00012,100,00013,900,000$31,000,000$1,200,0001,000,00011,300,000$13,500,000 OTHER INFORMATION:

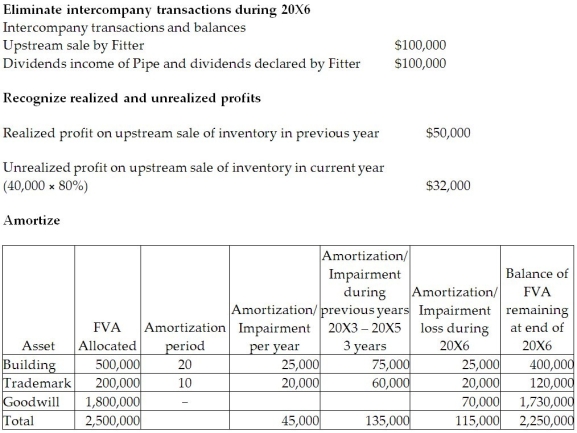

1. On December 31, 20X2, Fitter had a building with a fair value that was $500,000 greater than its carrying value. The building had an estimated remaining useful life of 20 years.

2. On December 31, 20X2, Fitter had trademark that was not reported on its balance sheet but had a fair value that was $200,000. The trademark is amortized over 10 years.

3. During 20X6, Fitter sold merchandise to Pipe for $100,000, a price that included a gross profit of $40,000. During 20X6, 20% of this merchandise was resold by Pipe and the other 80% remains in its December 31, 20X6, inventories. On December 31, 20X5, the inventories of Pipe contained merchandise purchased from Fitter on which Fitter had recognized a gross profit in the amount of $50,000.

4. During 20X6, it was determined that the goodwill arising at the date of acquisition was impaired and that an impairment loss of $70,000 should be recorded. No impairment had been charged in earlier years.

5. During 20X6, Pipe declared and paid dividends of $300,000, while Fitter declared and paid dividends of $100,000.

6. Pipe accounts for its investment in Fitter using the cost method.

The retained earnings of Pipe as at December 31, 20X5, equalled $12,000,000. On that date, Fitter had retained earnings of $9,800,000. Fitter has not issued any common stock since its acquisition by Pipe.

Required:

Prepare, in good form, a consolidated statement of comprehensive income for the year ended December 31, 20X6.

Consolidated Statement

Financial reports consolidating the assets, liabilities, and income of a parent organization along with its subsidiary companies, showing them as a single entity.

Goodwill Impairment

A write-down of the value of goodwill on a company's balance sheet when the fair value of the acquired company falls below the value recorded at the time of acquisition.

Gross Profit

Income remaining after the cost of goods sold has been deducted from total sales revenue, before deducting any operating expenses.

- Scrutinize and develop consolidated financial summaries.

Verified Answer

Learning Objectives

- Scrutinize and develop consolidated financial summaries.

Related questions

Which of the Following Pertaining to Consolidated Financial Statements Is ...

The Process of Preparing Consolidated Financial Statements Involves the Elimination ...

In General, Consolidated Financial Statements Should Be Prepared ...

In 20X5, Bing Created a Wholly Owned Subsidiary Called Bango ...

Ying Corporation Formed a New Subsidiary, Zang Limited, in 20X2 \( ...