Asked by Nikki Tajdar on Jul 09, 2024

Verified

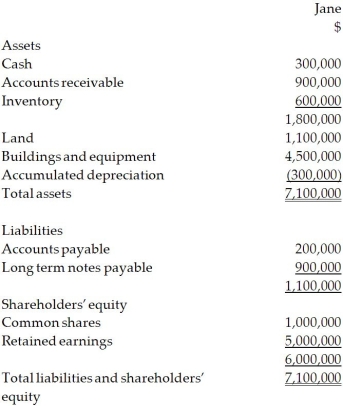

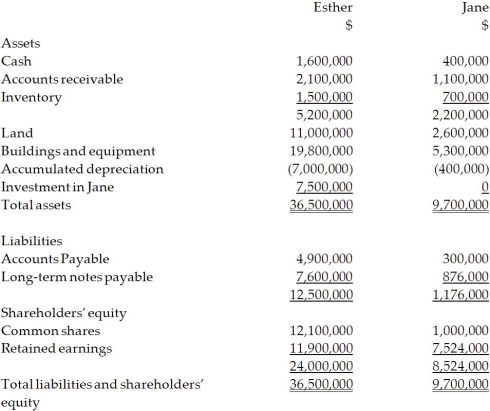

On December 31, 20X2, Esther Company purchased 80% of the outstanding common shares of Jane Company for $7.5 million in cash. On that date, the shareholders' equity of Jane totalled $6 million and consisted of $1 million in no par common shares and $5 million in retained earnings. Both companies use the straight-line method to calculate depreciation and amortization. The statement of financial position for Jane is provided below at December 31, 20X2.  For the year ending December 31, 20X4, the statements of comprehensive income for Esther and Jane were as follows: Esther Jane Sales and other revenue $12,500,000‾$6,804,000‾ Cost of goods sold 8,000,0004,000,000 Depreciation expense 1,500,0001,000,000 Other expenses 1,800,000‾1,200,000‾ Total expenses 11,300,000‾6,200,000‾ Net income $1,200,000‾$604,000‾\begin{array}{lrr}&\text { Esther } &\text { Jane } \\\text { Sales and other revenue } & \underline{\$ 12,500,000} & \underline{\$ 6,804,000} \\\text { Cost of goods sold } & 8,000,000 & 4,000,000 \\\text { Depreciation expense } & 1,500,000 & 1,000,000 \\\text { Other expenses } & \underline{1,800,000} & \underline{1,200,000} \\\text { Total expenses } & \underline{11,300,000} & \underline{6,200,000} \\\text { Net income } & \underline{\$ 1,200,000} & \underline{\$ 604,000}\end{array} Sales and other revenue Cost of goods sold Depreciation expense Other expenses Total expenses Net income Esther $12,500,0008,000,0001,500,0001,800,00011,300,000$1,200,000 Jane $6,804,0004,000,0001,000,0001,200,0006,200,000$604,000 At December 31, 20X4, the condensed statement of financial position for the two companies were as follows:

For the year ending December 31, 20X4, the statements of comprehensive income for Esther and Jane were as follows: Esther Jane Sales and other revenue $12,500,000‾$6,804,000‾ Cost of goods sold 8,000,0004,000,000 Depreciation expense 1,500,0001,000,000 Other expenses 1,800,000‾1,200,000‾ Total expenses 11,300,000‾6,200,000‾ Net income $1,200,000‾$604,000‾\begin{array}{lrr}&\text { Esther } &\text { Jane } \\\text { Sales and other revenue } & \underline{\$ 12,500,000} & \underline{\$ 6,804,000} \\\text { Cost of goods sold } & 8,000,000 & 4,000,000 \\\text { Depreciation expense } & 1,500,000 & 1,000,000 \\\text { Other expenses } & \underline{1,800,000} & \underline{1,200,000} \\\text { Total expenses } & \underline{11,300,000} & \underline{6,200,000} \\\text { Net income } & \underline{\$ 1,200,000} & \underline{\$ 604,000}\end{array} Sales and other revenue Cost of goods sold Depreciation expense Other expenses Total expenses Net income Esther $12,500,0008,000,0001,500,0001,800,00011,300,000$1,200,000 Jane $6,804,0004,000,0001,000,0001,200,0006,200,000$604,000 At December 31, 20X4, the condensed statement of financial position for the two companies were as follows:  OTHER INFORMATION:

OTHER INFORMATION:

1. On December 31, 20X2, Jane had a building with a fair value that was $450,000 greater than its carrying value. The building had an estimated remaining useful life of 15 years.

2. On December 31, 20X2, Jane had inventory with a fair value that was $150,000 less than its carrying value. This inventory was sold in 20X3.

3. During 20X3, Jane sold merchandise to Esther for $100,000, a price that included a gross profit of $50,000. During 20X3, 40% of this merchandise was resold by Esther and the other 60% remained in its December 31, 20X3, inventories. On December 31, 20X4, the inventories of Esther contained merchandise purchased from Jane on which Jane had recognized a gross profit in the amount of $20,000. Total sales from Jane to Esther were $150,000 during 20X4.

4. During 20X4, Esther declared and paid dividends of $300,000, while Jane declared and paid dividends of $100,000.

5. Esther accounts for its investment in Jane using the cost method.

Required:

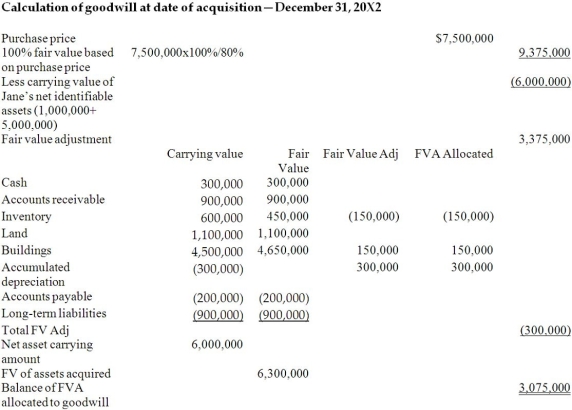

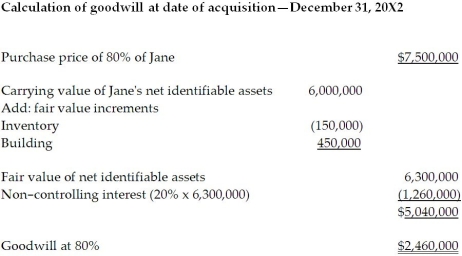

Calculate goodwill on the consolidated balance sheet at December 31, 20X4, under the entity method and the parent-company extension method. Explain the differences between the two balances.

Straight-Line Method

A method of calculating depreciation of an asset by evenly distributing its cost over its useful life.

Shareholders' Equity

The residual interest in the assets of a corporation that remains after deducting its liabilities, representing the ownership interest of shareholders.

Retained Earnings

The portion of a company's profits not distributed as dividends but reinvested in the business or kept as a reserve.

- Calculate and understand the treatment of goodwill, including impairment losses, in consolidated accounts.

Verified Answer

MB

Mackenzi BrockJul 14, 2024

Final Answer :

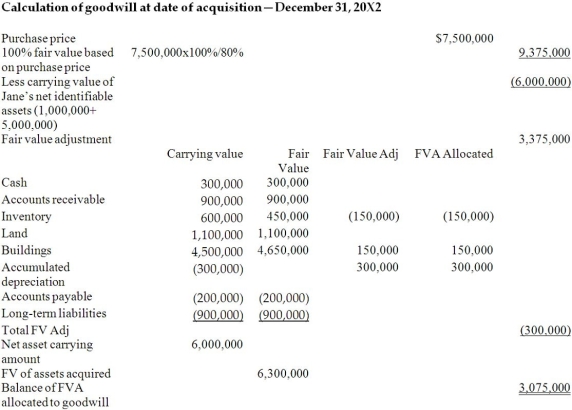

Entity method  Parent company extension method

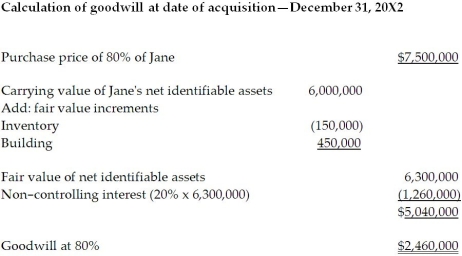

Parent company extension method  Since there was no impairment of goodwill during 20X3 and 20X4, the balance in the goodwill at December 31, 20X4, would be $2,460,000.

Since there was no impairment of goodwill during 20X3 and 20X4, the balance in the goodwill at December 31, 20X4, would be $2,460,000.

The difference of $615,000 ($3,075,000 - $2,460,000)between the two methods arises due to the goodwill included in the NCI. Under the parent company extension method, the NCI's portion of the goodwill, 20% × 3,075,000 = $615,000, is excluded from goodwill, as the NCI interest is calculated only the fair value of net identifiable assets, excluding goodwill.

Parent company extension method

Parent company extension method  Since there was no impairment of goodwill during 20X3 and 20X4, the balance in the goodwill at December 31, 20X4, would be $2,460,000.

Since there was no impairment of goodwill during 20X3 and 20X4, the balance in the goodwill at December 31, 20X4, would be $2,460,000.The difference of $615,000 ($3,075,000 - $2,460,000)between the two methods arises due to the goodwill included in the NCI. Under the parent company extension method, the NCI's portion of the goodwill, 20% × 3,075,000 = $615,000, is excluded from goodwill, as the NCI interest is calculated only the fair value of net identifiable assets, excluding goodwill.

Learning Objectives

- Calculate and understand the treatment of goodwill, including impairment losses, in consolidated accounts.