Asked by Rachel Dusett on Jul 09, 2024

Verified

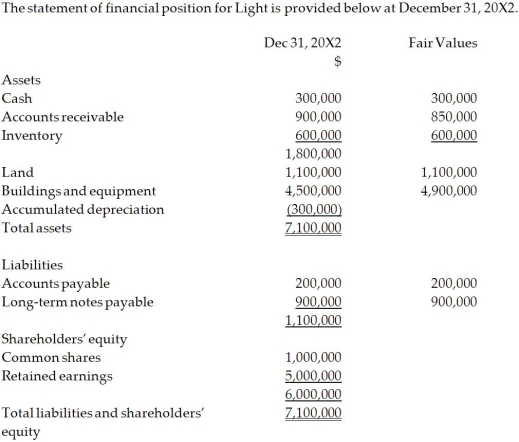

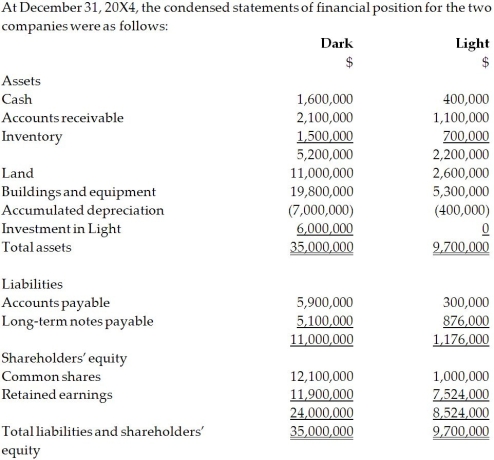

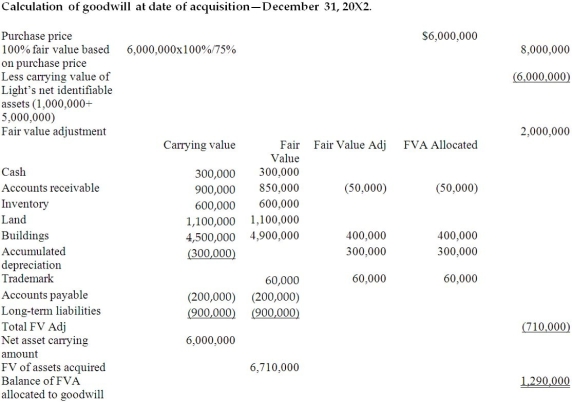

On December 31, 20X2, Dark Company purchased 75% of the outstanding common shares of Light Company for $6.0 million in cash. On that date, the shareholders' equity of Light totalled $6 million and consisted of $1 million in no par common shares and $5 million in retained earnings. Both companies use the straight-line method to calculate depreciation and amortization.  For the year ending December 31,20X431,20 \mathrm { X } 431,20X4 , the statements of comprehensive income for Dark and Light were as follows:

For the year ending December 31,20X431,20 \mathrm { X } 431,20X4 , the statements of comprehensive income for Dark and Light were as follows:

Dark Light Sales and other revenue $12,500,000$6,804,000 Cost of goods sold 8,000,0004,000,000 Depreciation expense 1,500,0001,000,000 Other expenses 1,800,0001,200,000 Total expenses 11,300,000‾6,200,000Net income$1,200,000‾$604,000‾\begin{array}{lcc}&\text { Dark } &\text { Light } \\ \text { Sales and other revenue } & \$ 12,500,000 & \$ 6,804,000 \\ \text { Cost of goods sold } & 8,000,000 & 4,000,000 \\\text { Depreciation expense } & 1,500,000 & 1,000,000 \\\text { Other expenses } & 1,800,000 & 1,200,000 \\ \text { Total expenses } & \underline{11,300,000} & 6,200,000 \\ \text {Net income}& \underline{\$ 1,200,000}& \underline{\$ 604,000} \\\end{array} Sales and other revenue Cost of goods sold Depreciation expense Other expenses Total expenses Net income Dark $12,500,0008,000,0001,500,0001,800,00011,300,000$1,200,000 Light $6,804,0004,000,0001,000,0001,200,0006,200,000$604,000  OTHER INFORMATION:

OTHER INFORMATION:

1. On December 31, 20X2, Light had a building with a fair value that was $4,900,000 and an estimated remaining useful life of 20 years.

2. On December 31, 20X2, Light had a trademark that had a fair value of $60,000. The trademark has an expected useful life of five years.

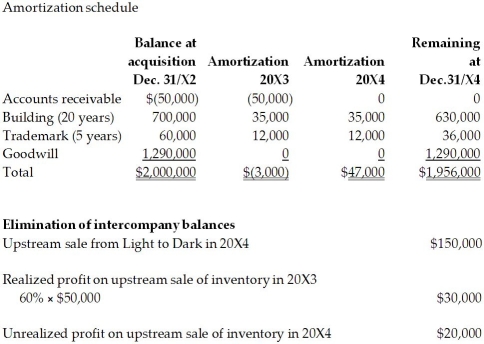

3. During 20X3, Light sold merchandise to Dark for $150,000, a price that included a gross profit of $50,000. During 20X3, 40% of this merchandise was resold by Dark and the other 60% remained in its December 31, 20X3, inventories.

4. On December 31, 20X4, the inventories of Dark contained merchandise purchased from Light on which Light had recognized a gross profit in the amount of $20,000. Total sales from Light to Dark were $150,000 during 20X4.

5. During 20X4, Dark declared and paid dividends of $300,000 while Light declared and paid dividends of $100,000.

6. Dark accounts for its investment in Light using the cost method.

Required:

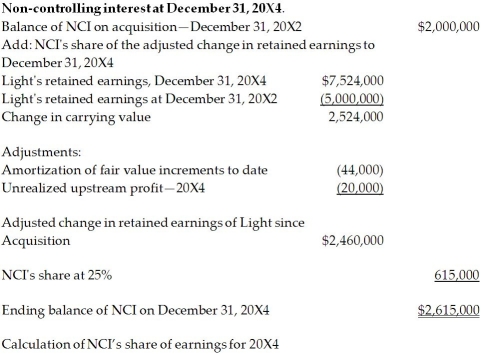

Calculate the non-controlling interest on the consolidated statement of financial position at December 31, 20X4, under the entity method.

Calculate the NCI's share of earnings for 20X4.

Non-Controlling Interest

The share of ownership in a subsidiary held by investors other than the parent company, often referred to as minority interest.

Cost Method

An accounting method used to value an investment, where the investment is recorded at its original purchase cost, with changes recognized only if dividends are received or there's a permanent decline in value.

- Ascertain the non-controlling interest (NCI) presented in the consolidated statement of financial status.

Verified Answer

Non-controlling interest is 25% × 8,000,000 (fair value)= 2,000,000

Non-controlling interest is 25% × 8,000,000 (fair value)= 2,000,000

Details Amount Net income of Light for 20X4 ( separate entity financial statement) 604,000 Add: Realized profit on upstream sale of inventory in previous year 30,000 Less: Unrealized profit on upstream sale of inventory in current year (20,000) Amortization of FVA during the year (47,000) Adjusted net income of Light for 20X4 567,000 NCI’s share @25%141,750\begin{array} { | l | r | } \hline \text { Details } & \text { Amount } \\\hline \text { Net income of Light for 20X4 ( separate entity financial statement) } & 604,000 \\\hline \text { Add: Realized profit on upstream sale of inventory in previous year } & 30,000 \\\hline \text { Less: } & \\\hline \text { Unrealized profit on upstream sale of inventory in current year } &( 20,000 )\\\hline \text { Amortization of FVA during the year } & ( 47,000 ) \\\hline \text { Adjusted net income of Light for 20X4 } & 567,000\\\hline \text { NCI's share } @ 25 \% & 141,750 \\\hline\end{array} Details Net income of Light for 20X4 ( separate entity financial statement) Add: Realized profit on upstream sale of inventory in previous year Less: Unrealized profit on upstream sale of inventory in current year Amortization of FVA during the year Adjusted net income of Light for 20X4 NCI’s share @25% Amount 604,00030,000(20,000)(47,000)567,000141,750

Details Amount Net income of Light for 20X4 ( separate entity financial statement) 604,000 Add: Realized profit on upstream sale of inventory in previous year 30,000 Less: Unrealized profit on upstream sale of inventory in current year (20,000) Amortization of FVA during the year (47,000) Adjusted net income of Light for 20X4 567,000 NCI’s share @25%141,750\begin{array} { | l | r | } \hline \text { Details } & \text { Amount } \\\hline \text { Net income of Light for 20X4 ( separate entity financial statement) } & 604,000 \\\hline \text { Add: Realized profit on upstream sale of inventory in previous year } & 30,000 \\\hline \text { Less: } & \\\hline \text { Unrealized profit on upstream sale of inventory in current year } &( 20,000 )\\\hline \text { Amortization of FVA during the year } & ( 47,000 ) \\\hline \text { Adjusted net income of Light for 20X4 } & 567,000\\\hline \text { NCI's share } @ 25 \% & 141,750 \\\hline\end{array} Details Net income of Light for 20X4 ( separate entity financial statement) Add: Realized profit on upstream sale of inventory in previous year Less: Unrealized profit on upstream sale of inventory in current year Amortization of FVA during the year Adjusted net income of Light for 20X4 NCI’s share @25% Amount 604,00030,000(20,000)(47,000)567,000141,750

Learning Objectives

- Ascertain the non-controlling interest (NCI) presented in the consolidated statement of financial status.

Related questions

Bowen Limited Purchased 60% of Sloch Co Sloch Sells Product ...

On January 1, 20X5, PX's Shareholders' Equity Was as Follows ...

The Consolidation Technique of NCI Allocation Is Based on the ...

The Measurement of the NCI Allocation Will Be Based on ...

Under the Entity Concept of Consolidation,the NCI Is Recognised as ...