Asked by Nicholas Alvarez on Jun 04, 2024

Verified

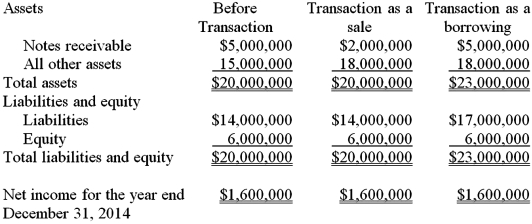

On December 31,2014,Barbie Bank securitized $3,000,000 of notes receivable using a securitization entity it had established.The cash received from the securitization entity was exactly $3,000,000,so it recognized no gain or loss on the transaction.Barbie Bank has the following account balances at December 31,2014 before the securitization was recorded:

Assets Notes receivable $5,000,000 All other assets 15,000,000 Total assets $20,000,000 Liabilities and equity Liabilities $14,000,000 Equity 6,000,000 Total liabilities and equity $20,000,000 Net income for the year ended December 31,2014$1,600,000\begin{array}{lr}\text { Assets }\\\text { Notes receivable } & \$ 5,000,000 \\\text { All other assets } & 15,000,000 \\\text { Total assets }&\$20,000,000\\\text { Liabilities and equity } & \\\text { Liabilities } & \$ 14,000,000 \\\text { Equity } & 6,000,000\\\text { Total liabilities and equity }&\$20,000,000\\\text { Net income for the year ended December } 31,2014&\$1,600,000\end{array} Assets Notes receivable All other assets Total assets Liabilities and equity Liabilities Equity Total liabilities and equity Net income for the year ended December 31,2014$5,000,00015,000,000$20,000,000$14,000,0006,000,000$20,000,000$1,600,000

Required:

a.Compute Barbie Bank's return-on-assets ratio and debt-to-equity ratio after completing this transaction assuming that the transaction was viewed as a sale under authoritative literature.

b.Compute Barbie Bank's return-on-assets ratio and debt-to-equity ratio after completing this transaction assuming that the transaction was viewed as a collateralized borrowing under authoritative literature.

The following table contains the data needed to compute the required ratios.

Securitization Entity

A special purpose vehicle (SPV) structured to pool various financial assets and then issue new securities backed by those assets.

Recognized No Gain or Loss

This occurs when the sale or disposal of an asset results in an outcome where the selling price is exactly equal to its book value, implying no profit or loss is reported.

- Assess the impact of debt restructuring on the financial statements and calculate related ratios.

Verified Answer

ZK

Zybrea KnightJun 06, 2024

Final Answer :

a.Return-on-assets ratio = $1,600,000 ÷ $20,000,000 = 8%

Debt-to-equity ratio = $14,000,000 ÷ $6,000,000 = 2.333

b.Return-on-assets ratio = $1,600,000 ÷ $23,000,000 = 6.95%

Debt-to-equity ratio = $17,000,000 ÷ $6,000,000 = 2.833

a.Return-on-assets ratio = $1,600,000 ÷ $20,000,000 = 8%

Debt-to-equity ratio = $14,000,000 ÷ $6,000,000 = 2.333

b.Return-on-assets ratio = $1,600,000 ÷ $23,000,000 = 6.95%

Debt-to-equity ratio = $17,000,000 ÷ $6,000,000 = 2.833

Learning Objectives

- Assess the impact of debt restructuring on the financial statements and calculate related ratios.