Asked by Caitlin Gamble on Jun 19, 2024

Verified

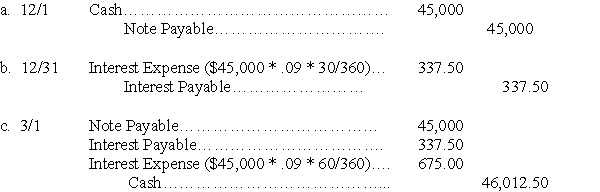

On December 1,Williams Company borrowed $45,000 cash from Second National Bank by signing a 90-day,9% note payable.

a.Prepare Williams' journal entry to record the issuance of the note payable.

b.Prepare Williams' journal entry to record the accrued interest due at December 31.

c.Prepare Williams' journal entry to record the payment of the note on March 1 of the next year.

Note Payable

A written promise to pay a specific amount of money, usually with interest, by a certain date to a designated party.

Accrued Interest

Interest that has been earned but not yet paid, recognized as an asset or liability prior to the exchange of cash.

- Compute the interest on debts represented by promissory notes and document the corresponding accounting entries.

Verified Answer

CM

Learning Objectives

- Compute the interest on debts represented by promissory notes and document the corresponding accounting entries.