Asked by Azriel Gamez on May 14, 2024

Verified

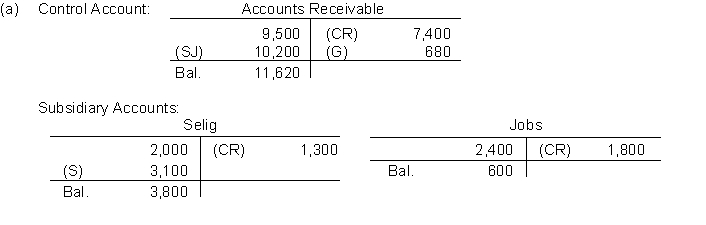

On December 1 the accounts receivable control account balance in the general ledger of the Picard Company was $9500. The accounts receivable subsidiary ledger contained the following detailed customer balances: Selig $2000 Jobs $2400 Taylor $2600 and Burton $2500. The following information is available from the company's special journals for the month of December:

Cash Receipts Journal: Cash received from Taylor $2600 from Selig $1300 from Munoz $1700 and from Jobs $1800.

Sales Journal: Sales to Minoz $3400 to Taylor $1800 to Selig $3100 and to Burton $1900.

Additionally Taylor returned defective merchandise for credit for $680. Selig returned defective merchandise for $600 which he had purchased for cash.

Instructions

(a) Using T-accounts for Accounts Receivable Control and the detail customer accounts post the activity for the month of December.

(b) Reconcile the accounts receivable control account with the subsidiary ledger by preparing a detail list of customer balances at December 31.

Accounts Receivable Control

Practices and procedures in place to monitor and manage the amounts owed to a business by its customers for goods or services delivered on credit.

Subsidiary Ledger

A detailed ledger that contains supporting information for a main accounting ledger, often used for accounts receivable or accounts payable.

Cash Receipts Journal

An accounting ledger in which all cash inflows or receipts are recorded.

- Learn the method of documenting transactions within the general and subsidiary ledgers.

- Gain insight into the critical role and function of subsidiary ledgers and control accounts for preserving precise accounting details.

- Determine and reconcile fluctuations in account totals over a designated period.

Verified Answer

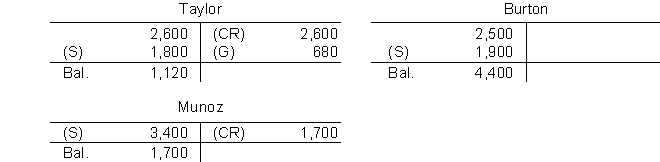

(b) Listing of accounts receivable at end of the month: Selig $3,800 Jobs 600 Taylor 1,120 Burton 4,400 Munoz 1,700‾ Total $11620‾\begin{array} { l r } \text { Selig } & \$ 3,800 \\\text { Jobs } & 600 \\\text { Taylor } & 1,120 \\\text { Burton } & 4,400 \\\text { Munoz } &\underline{ 1,700} \\\text { Total }&\underline{ \$ 11620 }\end{array} Selig Jobs Taylor Burton Munoz Total $3,8006001,1204,4001,700$11620 Accounts receivable balance

(b) Listing of accounts receivable at end of the month: Selig $3,800 Jobs 600 Taylor 1,120 Burton 4,400 Munoz 1,700‾ Total $11620‾\begin{array} { l r } \text { Selig } & \$ 3,800 \\\text { Jobs } & 600 \\\text { Taylor } & 1,120 \\\text { Burton } & 4,400 \\\text { Munoz } &\underline{ 1,700} \\\text { Total }&\underline{ \$ 11620 }\end{array} Selig Jobs Taylor Burton Munoz Total $3,8006001,1204,4001,700$11620 Accounts receivable balance

Learning Objectives

- Learn the method of documenting transactions within the general and subsidiary ledgers.

- Gain insight into the critical role and function of subsidiary ledgers and control accounts for preserving precise accounting details.

- Determine and reconcile fluctuations in account totals over a designated period.

Related questions

Indicate Whether Each of the Following Accounts Would Be Shown ...

If a Company Records Merchandise It Returns to Suppliers in ...

The Reference Column of the Accounts in the Accounts Payable ...

Bradshaw Company Has a Balance in Its Accounts Receivable Control ...

Which Accounts in the General Ledger Are Affected When the ...