Asked by Pierre Chew Seng Yaw on Jun 15, 2024

Verified

On April 1,Year 1,Astor Corp.purchased and placed a plant asset in service.The following information is available regarding the plant asset:

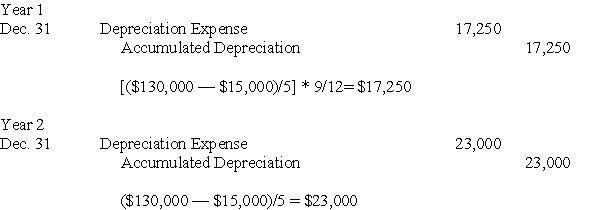

Make the necessary adjusting journal entries at December 31,Year 1,and December 31,Year 2 to record depreciation for each year under the straight-line depreciation method.

Make the necessary adjusting journal entries at December 31,Year 1,and December 31,Year 2 to record depreciation for each year under the straight-line depreciation method.

Straight-line Depreciation

A technique for distributing the expense of a physical asset across its lifespan in uniform yearly sums.

Plant Asset

An asset used in the operations of a business that is not intended for sale to customers and is referred to as property, plant, and equipment (PP&E) in accounting.

Adjusting Journal Entries

Journal entries made at the end of an accounting period to update certain accounts and ensure they accurately reflect the financial status of the business.

- Utilize the straight-line, double-declining-balance, and units-of-production techniques for calculating depreciation.

Verified Answer

Learning Objectives

- Utilize the straight-line, double-declining-balance, and units-of-production techniques for calculating depreciation.

Related questions

The Machine's Useful Life Is Estimated to Be 5 Years ...

The Machine's Book Value at the End of Year 3 ...

Determine the Machines' Second Year Depreciation Under the Straight-Line Method

The Book Value of the Machine at the End of ...

Determine the Machines' First Year Depreciation Under the Double-Declining-Balance Method