Asked by Darian Clark on Jun 10, 2024

Verified

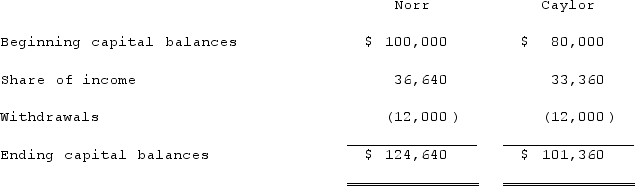

Norr and Caylor established a partnership on January 1, 2020.Norr invested cash of $100,000 and Caylor invested $30,000 in cash and equipment with a book value of $40,000 and fair value of $50,000.For both partners, the beginning capital balance was to equal the initial investment.Norr and Caylor agreed to the following procedure for sharing profits and losses:- 12% interest on the yearly beginning capital balance- $10 per hour of work that can be billed to the partnership's clients- the remainder allocated ona 3:2 ratioThe Articles of Partnership specified that each partner should withdraw no more than $1,000 per month, which is accounted as direct reduction of that partner's capital balance.For 2020, the partnership's income was $70,000.Norr had 1,000 billable hours, and Caylor worked 1,400 billable hours.In 2021, the partnership's income was $24,000, and Norr and Caylor worked 800 and 1,200 billable hours respectively.Each partner withdrew $1,000 per month throughout 2020and 2021.Determine the balance in both capital accounts at the end of 2020.

Billable Hours

The amount of an employee's work time that can be charged to a client, as in the context of professional services like legal advice or consultancy.

Capital Balance

Refers to the amount of money that a company's shareholders have invested in it.

Profit Sharing

A corporate program that gives employees a share in the company's profits based on its earnings.

- Understand the intricacies of partnership development and the implications for existing capital balances when new partners join.

- Understand the allocation of profits and losses in partnerships, including special allocations for salaries, interest, and service hours.

Verified Answer

JN

Learning Objectives

- Understand the intricacies of partnership development and the implications for existing capital balances when new partners join.

- Understand the allocation of profits and losses in partnerships, including special allocations for salaries, interest, and service hours.