Asked by Jessica Johnson on May 10, 2024

Verified

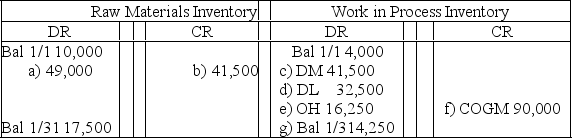

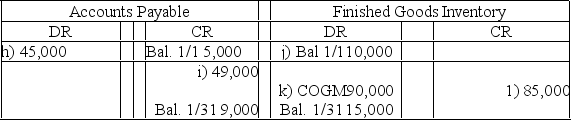

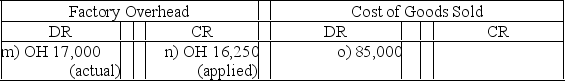

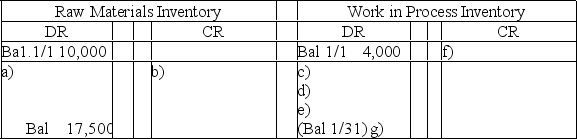

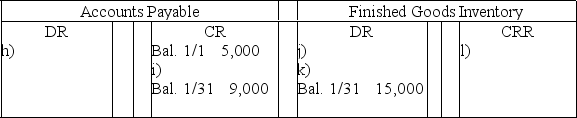

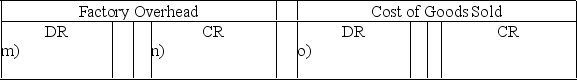

MOB Corp.applies overhead on the basis of direct labor costs.Its bookkeeper accidentally deleted most of the journal entries that had been recorded for January.A printout of the general ledger (in T-account form)showed the following:

A review of the prior year's financial statements,the current year's budget,and January's source documents produced the following information:

A review of the prior year's financial statements,the current year's budget,and January's source documents produced the following information:

(1)Accounts Payable is used for raw material purchases only.January purchases were $49,000.

(2)Factory overhead costs for January were $17,000 none of which is indirect materials.

(3)The January 1 balance for finished goods inventory was $10,000.

(4)There was a single job in process at January 31 with a cost of $2,000 for direct materials and $1,500 for direct labor.

(5)Total cost of goods manufactured for January was $90,000.

(6)All direct laborers earn the same rate ($13/hour).During January,2,500 direct labor hours were worked.

(7)The predetermined overhead rate is based on direct labor costs.Budgeted (expected)overhead for the year is $195,000 and budgeted (expected)direct labor is $390,000.

Fill in the missing amounts a)through o)above in the T-accounts above.

Direct Labor Costs

The expenses associated with the wages of employees who are directly involved in the production or manufacturing of goods or services.

Predetermined Overhead Rate

A rate used to allocate manufacturing overhead costs to products or job orders based on a projected activity level.

General Ledger

The main accounting record of a company that uses double-entry bookkeeping, containing all the financial accounts and statements.

- Note transactions and events by implementing a job order costing strategy.

- Gain proficiency in managing journal entries related to job order costing, including the adjustment of entries for overhead, regardless of being overapplied or underapplied.

Verified Answer

Learning Objectives

- Note transactions and events by implementing a job order costing strategy.

- Gain proficiency in managing journal entries related to job order costing, including the adjustment of entries for overhead, regardless of being overapplied or underapplied.

Related questions

When Direct Labor Is Assigned to Specific Jobs,________ Is Debited

Overapplied Overhead Should Be ________ to the Cost of Goods ...

Juarez Builders Incurred $285,000 of Labor Costs for Construction Jobs ...

Southwick Company Uses a Job Order Costing System ...

On November 2, Newsprint Manufacturing Purchases 5 Rolls of Paper ...