Asked by vishal patel on Apr 24, 2024

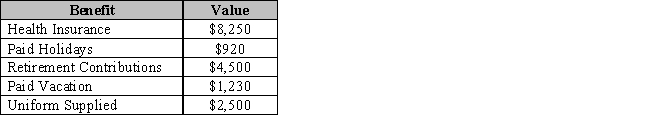

Michelle receives $32,000 per year as an assistant fast food manager.Her benefits include health insurance,paid holidays,retirement contributions,and a two-week paid vacation each year.Because she wears a uniform,Michelle calculates that she saves $2,500 on clothing costs per year.She constructed this table to show the value of each benefit.What is her annual salary,including benefits?

A) $32,000

B) $42,400

C) $4,690

D) $49,400

Paid Vacation

Employer-provided benefit that offers employees paid time off from work, allowing them personal time while still receiving their usual compensation.

Health Insurance

Insurance coverage that pays for medical and surgical expenses incurred by the insured, often provided by employers or purchased individually.

Retirement Contributions

Money set aside into retirement accounts, such as a 401(k) or IRA, often with tax advantages.

- Analyze the value of employee benefits and their impact on overall compensation.

Learning Objectives

- Analyze the value of employee benefits and their impact on overall compensation.

Related questions

Norah Is Interested in Developing Her Purchasing Policy ...

Alexander,an Electrician for ABC Electricals,is Paid $50 for Each Hour ...

When Jack Kilgore Looked at His Many Job Offers (He ...

Payment for Time Not Worked Includes Pension

Childcare, Eldercare and Extended Leave Policies Are All Examples of ...