Asked by Shenette Arnwine-Smart on Apr 30, 2024

Verified

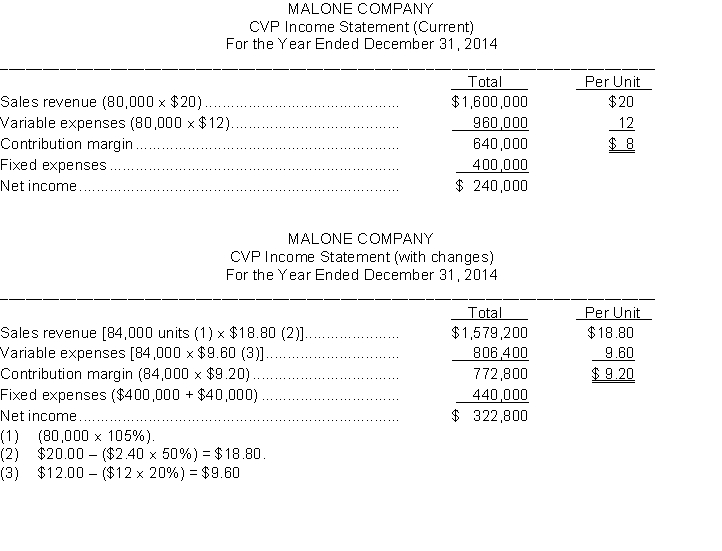

Malone Company had sales in 2014 of $1600000 on 80000 units. Variable costs totaled $960000 and fixed costs totaled $400000.

A new raw material is available that will decrease the variable costs per unit by 20% (or $2.40). However to process the new raw material fixed operating costs will increase by $40000. Management feels that one-half of the decline in the variable costs per unit should be passed on to customers in the form of a sales price reduction. The marketing department expects that this sales price reduction will result in a 5% increase in the number of units sold.

Instructions

Prepare a CVP income statement for 2014 assuming the changes are made as described.

Variable Costs

Financial outlays that adjust based on the quantity of products made or the scale of sales transactions.

Fixed Costs

Business expenses that do not change in proportion to the level of goods or services that a company produces over a short term.

CVP Income Statement

A financial statement that shows the effects of changes in cost and volume on a company's profits, based on Cost-Volume-Profit analysis.

- Assess the economic outcomes and project future achievements through the application of CVP theories.

- Determine methods for reaching specific profit goals by adjusting sales, expenses, and pricing strategies.

- Examine how alterations in cost configurations influence profit levels.

Verified Answer

ZK

Learning Objectives

- Assess the economic outcomes and project future achievements through the application of CVP theories.

- Determine methods for reaching specific profit goals by adjusting sales, expenses, and pricing strategies.

- Examine how alterations in cost configurations influence profit levels.