Asked by sangeetha ajith on Jun 11, 2024

Verified

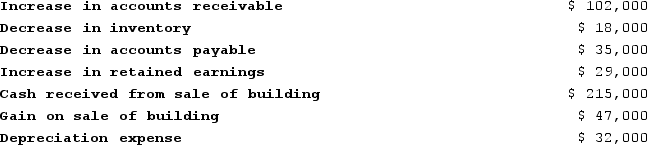

Majorn Auto Parts Store had net income of $81,000 for the year just ended. Majorn collected the following additional information to prepare its statement of cash flows for the year:  Majorn uses the indirect method to prepare its statement of cash flows. What is Majorn's net cash provided by (used in) operating activities?

Majorn uses the indirect method to prepare its statement of cash flows. What is Majorn's net cash provided by (used in) operating activities?

A) $41,000

B) $(53,000)

C) $185,000

D) $279,000

Indirect Method

A technique used in cash flow statements where net income is adjusted for non-cash transactions and changes in working capital to arrive at cash flow from operating activities.

Operating Activities

Activities that relate directly to the primary operations of a company, such as sales and service activities, and are reflected in the company's cash flows.

Net Income

The total profit of a company after all expenses, including taxes and operating costs, have been subtracted from total revenue.

- Calculate net cash provided by or used in operating activities using the indirect method.

Verified Answer

- Accounts receivable increased by $29,000 (which means that sales were made on credit and not collected in cash, resulting in a decrease in cash)

- Inventory increased by $17,000 (which means that more inventory was purchased than sold, resulting in a decrease in cash)

- Prepaid expenses increased by $2,000 (which means that the company paid for expenses in advance, resulting in a decrease in cash)

- Accounts payable increased by $16,000 (which means that the company purchased goods on credit and did not pay for them yet, resulting in an increase in cash)

- Salaries payable decreased by $23,000 (which means that the company paid wages owed from a prior period, resulting in a decrease in cash)

- Income taxes payable increased by $3,000 (which means that the company did not pay all of its income taxes owed for the year, resulting in an increase in cash)

To calculate the net cash provided by (used in) operating activities, we would start with net income of $81,000 and then make adjustments for these changes in operating assets and liabilities:

Net income: $81,000

Add back depreciation expense: $21,000

Decrease in accounts payable: $16,000

Decrease in salaries payable: $23,000

Increase in income taxes payable: $3,000

Adjustment for increase in accounts receivable: -$29,000

Adjustment for increase in inventory: -$17,000

Adjustment for increase in prepaid expenses: -$2,000

Net cash provided by (used in) operating activities: -$50,000

(Note: This is a cash outflow, so the answer is B)

Learning Objectives

- Calculate net cash provided by or used in operating activities using the indirect method.

Related questions

Accounts Receivable Resulting from Sales to Customers Amounted to $40,000 ...

If Accounts Payable Have Increased During a Period ...

When Computing the Net Cash Provided by Operating Activities Under ...

Indicate Whether Each of the Following Would Be Added to ...

Mattix Corporation's Balance Sheet and Income Statement Appear Below ...