Asked by Janelle Ouzts on Apr 29, 2024

Verified

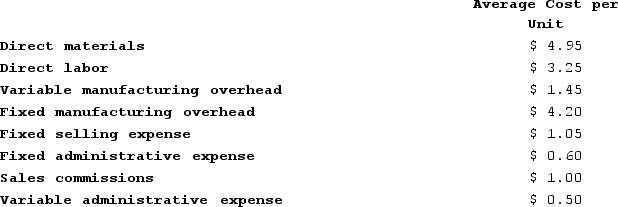

Macy Corporation's relevant range of activity is 4,000 units to 8,000 units. When it produces and sells 6,000 units, its average costs per unit are as follows:  If the selling price is $23.50 per unit, the contribution margin per unit sold is closest to:

If the selling price is $23.50 per unit, the contribution margin per unit sold is closest to:

A) $9.65

B) $6.50

C) $15.30

D) $12.35

Contribution Margin

The gap between sales income and variable expenses, demonstrating the extent to which income aids in covering constant costs and producing earnings.

Average Costs

The cost per unit of output on average, calculated by dividing total costs by the total quantity of output.

Selling Price

Selling price is the amount of money a buyer pays to purchase a product or service from a seller.

- Absorb and make use of cost calculations to foresee costs at varying levels of production intensity.

- Scrutinize how fluctuations in production output affect the fixed and variable costs on a per-unit basis.

Verified Answer

RD

Rebecca DorcelyMay 05, 2024

Final Answer :

D

Explanation :

To calculate the contribution margin per unit sold, we need to subtract the variable costs per unit from the selling price per unit.

First, we need to determine the total variable costs per unit. From the provided information, we know that the average cost per unit when producing and selling 6,000 units is $14.50.

The variable cost per unit can then be calculated as follows:

Variable cost per unit = Average cost per unit - Fixed cost per unit

Variable cost per unit = $14.50 - ($53,000 / 6,000 units)

Variable cost per unit = $14.50 - $8.83

Variable cost per unit = $5.67

Next, we can calculate the contribution margin per unit sold:

Contribution margin per unit sold = Selling price per unit - Variable cost per unit

Contribution margin per unit sold = $23.50 - $5.67

Contribution margin per unit sold = $17.83

Therefore, the contribution margin per unit sold is closest to $12.35 (option D).

First, we need to determine the total variable costs per unit. From the provided information, we know that the average cost per unit when producing and selling 6,000 units is $14.50.

The variable cost per unit can then be calculated as follows:

Variable cost per unit = Average cost per unit - Fixed cost per unit

Variable cost per unit = $14.50 - ($53,000 / 6,000 units)

Variable cost per unit = $14.50 - $8.83

Variable cost per unit = $5.67

Next, we can calculate the contribution margin per unit sold:

Contribution margin per unit sold = Selling price per unit - Variable cost per unit

Contribution margin per unit sold = $23.50 - $5.67

Contribution margin per unit sold = $17.83

Therefore, the contribution margin per unit sold is closest to $12.35 (option D).

Learning Objectives

- Absorb and make use of cost calculations to foresee costs at varying levels of production intensity.

- Scrutinize how fluctuations in production output affect the fixed and variable costs on a per-unit basis.