Asked by Madeline Boutot on Jul 08, 2024

Verified

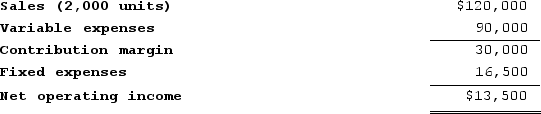

Lofft Corporation has provided the following contribution format income statement. Assume that the following information is within the relevant range.  Using the degree of operating leverage, the estimated percent increase in net operating income as the result of a 10% increase in salesvolume is closest to: (Round your intermediate calculations to 1 decimal place.)

Using the degree of operating leverage, the estimated percent increase in net operating income as the result of a 10% increase in salesvolume is closest to: (Round your intermediate calculations to 1 decimal place.)

A) 1.13%

B) 88.89%

C) 22.22%

D) 4.50%

Operating Leverage

The extent to which a company uses fixed costs in its cost structure, impacting its earnings volatility.

Net Operating Income

Net Operating Income (NOI) is a financial metric that calculates a company's income after all operating expenses, excluding taxes and interest, have been deducted from total revenue.

Salesvolume

Sales volume refers to the number of units of a product or service sold by a company in a specified period.

- Learn to evaluate and calculate the measure of operating leverage.

Verified Answer

With a 10% increase in sales volume, total sales revenue would increase to $660,000 ($600,000 x 1.1). The contribution margin would increase by 10% to $330,000 ($300,000 x 1.1). Using the DOL, the estimated percent increase in net operating income would be 22.22% (3.33 x 0.1). Therefore, the answer is C.

Learning Objectives

- Learn to evaluate and calculate the measure of operating leverage.

Related questions

Lubke Corporation's Contribution Format Income Statement for the Most Recent ...

Sun Corporation Has Provided the Following Contribution Format Income Statement ...

Sun Corporation Has Provided the Following Contribution Format Income Statement ...

The Degree of Operating Leverage Is Closest To

Bois Corporation Has Provided Its Contribution Format Income Statement for ...