Asked by Jazmin Blanco Ferrufino on Jun 22, 2024

Verified

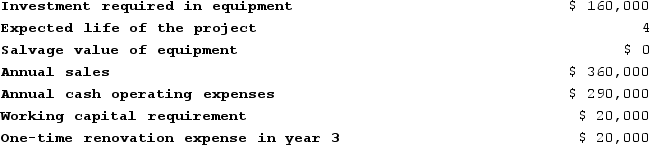

Layer Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 8%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The income tax expense in year 2 is:

The company's income tax rate is 30% and its after-tax discount rate is 8%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The income tax expense in year 2 is:

A) $3,000

B) $9,000

C) $21,000

D) $6,000

After-Tax Discount Rate

A rate used in capital budgeting that takes into account the effects of taxes on the project's cash flows.

Straight-Line Depreciation

A strategy for apportioning the cost of a solid asset over its period of utility in uniform annual portions.

- Compute the tax expense on income related to projects in capital budgeting.

- Examine how working capital adjustments affect the cash flows within a project.

Verified Answer

MG

Michael GallegosJun 29, 2024

Final Answer :

B

Explanation :

To calculate the income tax expense in year 2, first we need to calculate the taxable income in year 2.

The cash inflows in year 2 are $27,000 and the depreciation expense in year 2 is ($75,000/3) = $25,000. Therefore, the taxable income in year 2 is:

Taxable income Year 2 = $27,000 - $25,000 = $2,000

The income tax rate is 30%, so the income tax expense in year 2 is:

Income Tax Expense Year 2 = $2,000 x 30% = $6000

Therefore, the correct answer is B.

The cash inflows in year 2 are $27,000 and the depreciation expense in year 2 is ($75,000/3) = $25,000. Therefore, the taxable income in year 2 is:

Taxable income Year 2 = $27,000 - $25,000 = $2,000

The income tax rate is 30%, so the income tax expense in year 2 is:

Income Tax Expense Year 2 = $2,000 x 30% = $6000

Therefore, the correct answer is B.

Learning Objectives

- Compute the tax expense on income related to projects in capital budgeting.

- Examine how working capital adjustments affect the cash flows within a project.

Related questions

Fontana Corporation Is Considering a Capital Budgeting Project That Would ...

A New Project Will Cause Accounts Payable to Increase by ...

Kay's Nautique Is Considering a Project Which Will Require Additional ...

The Correct Formula of Project Cash Flow Is Sales - ...

A Project Increases Accounts Receivable and Accounts Payable by $500,000 ...