Asked by Joshua Reavis on Apr 26, 2024

Verified

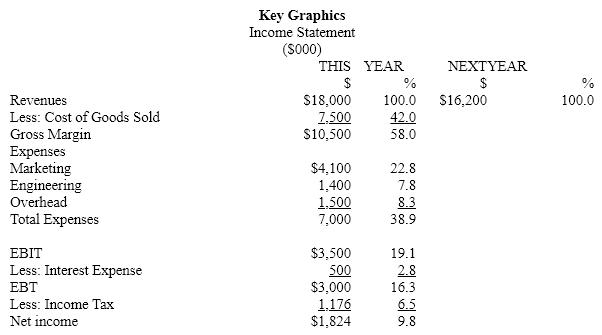

Key Graphics expects to finish the current year with the financial results indicated on the worksheet given below. Develop next year's income statement and ending balance sheet using that information and the following planning assumptions and facts. Note that due to an economic slowdown, Key Graphics is expecting a ten percent reduction in revenue. It is attempting to cut expenditures by an even greater percentage, resulting in a larger net profit. Work to the nearest thousand dollars.

PLANNING ASSUMPTIONS AND FACTS

Income Statement Items

1.Revenue declines by 10%.

2.The cost ratio will improve by 3%.

3. Spending in the Marketing Department will be held to 22% of revenue.

4. Engineering and Overhead expenses will be cut by 15%.

5.The combined state and federal income tax rate will be 40%

6. Interest on all borrowing will be 9 percent.

7. Interest expenses are based on 1/2 of the prior year's long-term debt and 1/2 of the current year's long-term debt.)

Balance Sheet Items

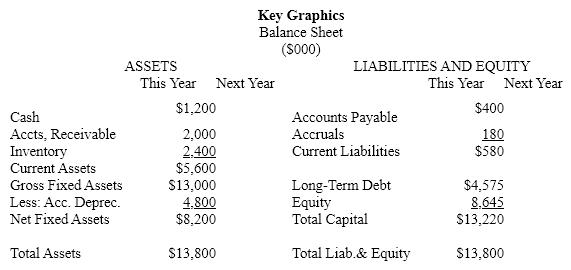

1.Cash balances will remain constant.

2. The ACP will be 30 days. (Use ending balances.)

3. The inventory turnover ratio will be 4 times. (Use ending balances.)

4. Capital spending is expected to be $6.0M. The average depreciation life of the assets to be acquired is 5 years and straight-line depreciation is used. Old assets will deprecation by $1,700,000.

5.Accounts payable is expected to be 40% of inventory.

6. Accruals will rise by $10,000

7.$1,500,000 of dividends will be paid.

8.There are no stock splits.

Economic Slowdown

A period of reduced economic activity and growth rates compared to previous periods.

Net Profit

The amount of money that remains from revenues after all operating expenses, taxes, and costs have been subtracted; a key indicator of financial health.

ACP

Accelerated cost recovery system, a method used for calculating depreciation expenses for tax purposes.

- Interpret financial accounts and predict future financial conditions.

- Translate theoretical foundations into action within practical financial planning exercises.

Verified Answer

SB

Skylar BaileyMay 01, 2024

Final Answer :  - $1500 Step 3: $14,608 - LTD<sub>Next Year</sub> = $8,645 + Net income<sub>Next Year</sub> - $1,500 $7,463 - LTD<sub>Next Year</sub> = Net income<sub>Next Year</sub> Step 4: Net income<sub>Next Year</sub> = [$3853 - 0.09(.5)(4575) - 0.09(0.5)(L/T Debt<sub>Next Year</sub>)](1-0.4) Net income<sub>Next Year</sub> = 2188 + 0.027 LTD<sub>Next Year</sub> Step 5: $7,463 - LTD<sub>Next Year</sub> = $2,188 + 0.027 LTD<sub>Next Year</sub> $5,275 = 0.973 LTD<sub>Next Year</sub> $5,421 = LTD<sub>Next Year</sub> Step 6: Equity<sub>Next Year</sub> = $14,608 - 5421 = $9,187 Verification: Interest Expense: $4575 (.5)(0.09) + $5421 (.5)(0.09) = $206 + 244 = $450 EBT = 3853 - $450 = $3403 Net income = $3403 (.6) = $2042 Change in Retained Earnings = $2042 - 1500 = $542 New Retained Earnings = 8645 + 542 = 9187](https://d2lvgg3v3hfg70.cloudfront.net/TBX9185/11ebf457_d3fc_47c8_ad07_f55b5838b221_TBX9185_00.jpg)

- $1500 Step 3: $14,608 - LTD<sub>Next Year</sub> = $8,645 + Net income<sub>Next Year</sub> - $1,500 $7,463 - LTD<sub>Next Year</sub> = Net income<sub>Next Year</sub> Step 4: Net income<sub>Next Year</sub> = [$3853 - 0.09(.5)(4575) - 0.09(0.5)(L/T Debt<sub>Next Year</sub>)](1-0.4) Net income<sub>Next Year</sub> = 2188 + 0.027 LTD<sub>Next Year</sub> Step 5: $7,463 - LTD<sub>Next Year</sub> = $2,188 + 0.027 LTD<sub>Next Year</sub> $5,275 = 0.973 LTD<sub>Next Year</sub> $5,421 = LTD<sub>Next Year</sub> Step 6: Equity<sub>Next Year</sub> = $14,608 - 5421 = $9,187 Verification: Interest Expense: $4575 (.5)(0.09) + $5421 (.5)(0.09) = $206 + 244 = $450 EBT = 3853 - $450 = $3403 Net income = $3403 (.6) = $2042 Change in Retained Earnings = $2042 - 1500 = $542 New Retained Earnings = 8645 + 542 = 9187](https://d2lvgg3v3hfg70.cloudfront.net/TBX9185/11ebf457_d3fc_47c9_ad07_0798fa092ca2_TBX9185_00.jpg) Total Liab.& Equity $13,800 $15,430

Total Liab.& Equity $13,800 $15,430

Supporting Calculations:

- $1500 Step 3: $14,608 - LTD<sub>Next Year</sub> = $8,645 + Net income<sub>Next Year</sub> - $1,500 $7,463 - LTD<sub>Next Year</sub> = Net income<sub>Next Year</sub> Step 4: Net income<sub>Next Year</sub> = [$3853 - 0.09(.5)(4575) - 0.09(0.5)(L/T Debt<sub>Next Year</sub>)](1-0.4) Net income<sub>Next Year</sub> = 2188 + 0.027 LTD<sub>Next Year</sub> Step 5: $7,463 - LTD<sub>Next Year</sub> = $2,188 + 0.027 LTD<sub>Next Year</sub> $5,275 = 0.973 LTD<sub>Next Year</sub> $5,421 = LTD<sub>Next Year</sub> Step 6: Equity<sub>Next Year</sub> = $14,608 - 5421 = $9,187 Verification: Interest Expense: $4575 (.5)(0.09) + $5421 (.5)(0.09) = $206 + 244 = $450 EBT = 3853 - $450 = $3403 Net income = $3403 (.6) = $2042 Change in Retained Earnings = $2042 - 1500 = $542 New Retained Earnings = 8645 + 542 = 9187](https://d2lvgg3v3hfg70.cloudfront.net/TBX9185/11ebf457_d3fc_47ca_ad07_dd53153a9af7_TBX9185_00.jpg)

- $1500 Step 3: $14,608 - LTD<sub>Next Year</sub> = $8,645 + Net income<sub>Next Year</sub> - $1,500 $7,463 - LTD<sub>Next Year</sub> = Net income<sub>Next Year</sub> Step 4: Net income<sub>Next Year</sub> = [$3853 - 0.09(.5)(4575) - 0.09(0.5)(L/T Debt<sub>Next Year</sub>)](1-0.4) Net income<sub>Next Year</sub> = 2188 + 0.027 LTD<sub>Next Year</sub> Step 5: $7,463 - LTD<sub>Next Year</sub> = $2,188 + 0.027 LTD<sub>Next Year</sub> $5,275 = 0.973 LTD<sub>Next Year</sub> $5,421 = LTD<sub>Next Year</sub> Step 6: Equity<sub>Next Year</sub> = $14,608 - 5421 = $9,187 Verification: Interest Expense: $4575 (.5)(0.09) + $5421 (.5)(0.09) = $206 + 244 = $450 EBT = 3853 - $450 = $3403 Net income = $3403 (.6) = $2042 Change in Retained Earnings = $2042 - 1500 = $542 New Retained Earnings = 8645 + 542 = 9187](https://d2lvgg3v3hfg70.cloudfront.net/TBX9185/11ebf457_d3fc_47cb_ad07_b987f80d4386_TBX9185_00.jpg) Estimation of Equity in Capital Structure

Estimation of Equity in Capital Structure

Step 1. TA = CL + LTD + E

15,430 = 632 + 190 + 822 + LTDNext Year + EquityNext Year

15,430 = 822 + LTDNext Year + EquityNext Year

EquityNext Year = $15,430 - 822 - L/T DebtNext Year

EquityNext Year = $14,608 - L/T DebtNext Year

Step 2: EquityNext Year = Retained EarningsThis Year - Net incomeNext Year - Dividend Payments

EquityNext Year =

$8,645 + [$3853 - 0.09(0.5)(4575) - 0.09(0.5)(L/T DebtNext Year)](1-0.4) - $1500

Step 3: $14,608 - LTDNext Year = $8,645 + Net incomeNext Year - $1,500

$7,463 - LTDNext Year = Net incomeNext Year

Step 4: Net incomeNext Year = [$3853 - 0.09(.5)(4575) - 0.09(0.5)(L/T DebtNext Year)](1-0.4)

Net incomeNext Year = 2188 + 0.027 LTDNext Year

Step 5: $7,463 - LTDNext Year = $2,188 + 0.027 LTDNext Year

$5,275 = 0.973 LTDNext Year

$5,421 = LTDNext Year

Step 6: EquityNext Year = $14,608 - 5421 = $9,187

Verification:

Interest Expense: $4575 (.5)(0.09) + $5421 (.5)(0.09) = $206 + 244 = $450

EBT = 3853 - $450 = $3403

Net income = $3403 (.6) = $2042

Change in Retained Earnings = $2042 - 1500 = $542

New Retained Earnings = 8645 + 542 = 9187

- $1500 Step 3: $14,608 - LTD<sub>Next Year</sub> = $8,645 + Net income<sub>Next Year</sub> - $1,500 $7,463 - LTD<sub>Next Year</sub> = Net income<sub>Next Year</sub> Step 4: Net income<sub>Next Year</sub> = [$3853 - 0.09(.5)(4575) - 0.09(0.5)(L/T Debt<sub>Next Year</sub>)](1-0.4) Net income<sub>Next Year</sub> = 2188 + 0.027 LTD<sub>Next Year</sub> Step 5: $7,463 - LTD<sub>Next Year</sub> = $2,188 + 0.027 LTD<sub>Next Year</sub> $5,275 = 0.973 LTD<sub>Next Year</sub> $5,421 = LTD<sub>Next Year</sub> Step 6: Equity<sub>Next Year</sub> = $14,608 - 5421 = $9,187 Verification: Interest Expense: $4575 (.5)(0.09) + $5421 (.5)(0.09) = $206 + 244 = $450 EBT = 3853 - $450 = $3403 Net income = $3403 (.6) = $2042 Change in Retained Earnings = $2042 - 1500 = $542 New Retained Earnings = 8645 + 542 = 9187](https://d2lvgg3v3hfg70.cloudfront.net/TBX9185/11ebf457_d3fc_47c8_ad07_f55b5838b221_TBX9185_00.jpg)

- $1500 Step 3: $14,608 - LTD<sub>Next Year</sub> = $8,645 + Net income<sub>Next Year</sub> - $1,500 $7,463 - LTD<sub>Next Year</sub> = Net income<sub>Next Year</sub> Step 4: Net income<sub>Next Year</sub> = [$3853 - 0.09(.5)(4575) - 0.09(0.5)(L/T Debt<sub>Next Year</sub>)](1-0.4) Net income<sub>Next Year</sub> = 2188 + 0.027 LTD<sub>Next Year</sub> Step 5: $7,463 - LTD<sub>Next Year</sub> = $2,188 + 0.027 LTD<sub>Next Year</sub> $5,275 = 0.973 LTD<sub>Next Year</sub> $5,421 = LTD<sub>Next Year</sub> Step 6: Equity<sub>Next Year</sub> = $14,608 - 5421 = $9,187 Verification: Interest Expense: $4575 (.5)(0.09) + $5421 (.5)(0.09) = $206 + 244 = $450 EBT = 3853 - $450 = $3403 Net income = $3403 (.6) = $2042 Change in Retained Earnings = $2042 - 1500 = $542 New Retained Earnings = 8645 + 542 = 9187](https://d2lvgg3v3hfg70.cloudfront.net/TBX9185/11ebf457_d3fc_47c9_ad07_0798fa092ca2_TBX9185_00.jpg) Total Liab.& Equity $13,800 $15,430

Total Liab.& Equity $13,800 $15,430Supporting Calculations:

- $1500 Step 3: $14,608 - LTD<sub>Next Year</sub> = $8,645 + Net income<sub>Next Year</sub> - $1,500 $7,463 - LTD<sub>Next Year</sub> = Net income<sub>Next Year</sub> Step 4: Net income<sub>Next Year</sub> = [$3853 - 0.09(.5)(4575) - 0.09(0.5)(L/T Debt<sub>Next Year</sub>)](1-0.4) Net income<sub>Next Year</sub> = 2188 + 0.027 LTD<sub>Next Year</sub> Step 5: $7,463 - LTD<sub>Next Year</sub> = $2,188 + 0.027 LTD<sub>Next Year</sub> $5,275 = 0.973 LTD<sub>Next Year</sub> $5,421 = LTD<sub>Next Year</sub> Step 6: Equity<sub>Next Year</sub> = $14,608 - 5421 = $9,187 Verification: Interest Expense: $4575 (.5)(0.09) + $5421 (.5)(0.09) = $206 + 244 = $450 EBT = 3853 - $450 = $3403 Net income = $3403 (.6) = $2042 Change in Retained Earnings = $2042 - 1500 = $542 New Retained Earnings = 8645 + 542 = 9187](https://d2lvgg3v3hfg70.cloudfront.net/TBX9185/11ebf457_d3fc_47ca_ad07_dd53153a9af7_TBX9185_00.jpg)

- $1500 Step 3: $14,608 - LTD<sub>Next Year</sub> = $8,645 + Net income<sub>Next Year</sub> - $1,500 $7,463 - LTD<sub>Next Year</sub> = Net income<sub>Next Year</sub> Step 4: Net income<sub>Next Year</sub> = [$3853 - 0.09(.5)(4575) - 0.09(0.5)(L/T Debt<sub>Next Year</sub>)](1-0.4) Net income<sub>Next Year</sub> = 2188 + 0.027 LTD<sub>Next Year</sub> Step 5: $7,463 - LTD<sub>Next Year</sub> = $2,188 + 0.027 LTD<sub>Next Year</sub> $5,275 = 0.973 LTD<sub>Next Year</sub> $5,421 = LTD<sub>Next Year</sub> Step 6: Equity<sub>Next Year</sub> = $14,608 - 5421 = $9,187 Verification: Interest Expense: $4575 (.5)(0.09) + $5421 (.5)(0.09) = $206 + 244 = $450 EBT = 3853 - $450 = $3403 Net income = $3403 (.6) = $2042 Change in Retained Earnings = $2042 - 1500 = $542 New Retained Earnings = 8645 + 542 = 9187](https://d2lvgg3v3hfg70.cloudfront.net/TBX9185/11ebf457_d3fc_47cb_ad07_b987f80d4386_TBX9185_00.jpg) Estimation of Equity in Capital Structure

Estimation of Equity in Capital Structure Step 1. TA = CL + LTD + E

15,430 = 632 + 190 + 822 + LTDNext Year + EquityNext Year

15,430 = 822 + LTDNext Year + EquityNext Year

EquityNext Year = $15,430 - 822 - L/T DebtNext Year

EquityNext Year = $14,608 - L/T DebtNext Year

Step 2: EquityNext Year = Retained EarningsThis Year - Net incomeNext Year - Dividend Payments

EquityNext Year =

$8,645 + [$3853 - 0.09(0.5)(4575) - 0.09(0.5)(L/T DebtNext Year)](1-0.4) - $1500

Step 3: $14,608 - LTDNext Year = $8,645 + Net incomeNext Year - $1,500

$7,463 - LTDNext Year = Net incomeNext Year

Step 4: Net incomeNext Year = [$3853 - 0.09(.5)(4575) - 0.09(0.5)(L/T DebtNext Year)](1-0.4)

Net incomeNext Year = 2188 + 0.027 LTDNext Year

Step 5: $7,463 - LTDNext Year = $2,188 + 0.027 LTDNext Year

$5,275 = 0.973 LTDNext Year

$5,421 = LTDNext Year

Step 6: EquityNext Year = $14,608 - 5421 = $9,187

Verification:

Interest Expense: $4575 (.5)(0.09) + $5421 (.5)(0.09) = $206 + 244 = $450

EBT = 3853 - $450 = $3403

Net income = $3403 (.6) = $2042

Change in Retained Earnings = $2042 - 1500 = $542

New Retained Earnings = 8645 + 542 = 9187

Learning Objectives

- Interpret financial accounts and predict future financial conditions.

- Translate theoretical foundations into action within practical financial planning exercises.