Asked by Marcos Medina Rodriguez on Jul 27, 2024

Verified

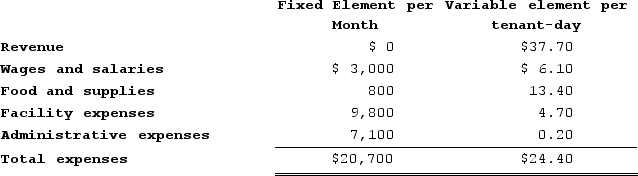

Kawamura Kennel uses tenant-days as its measure of activity; an animal housed in the kennel for one day is counted as one tenant-day. During December, the kennel budgeted for 2,300 tenant-days, but its actual level of activity was 2,320 tenant-days. The kennel has provided the following data concerning the formulas to be used in its budgeting:  The net operating income in the planning budget for December would be closest to:

The net operating income in the planning budget for December would be closest to:

A) $10,156

B) $9,890

C) $7,309

D) $7,184

Net Operating Income

A measure of a company's profitability, calculated as the revenue from operations minus the operating expenses, excluding interest and taxes.

Tenant-Days

A metric in property management that multiplies the number of tenants by the number of days they occupy a space, useful for tracking occupancy and usage.

Planning Budget

A budget created at the beginning of a budgeting period, based on projected values and assumptions for that period.

- Gain insights into the theoretical underpinning and practical application of flexible budgets in variance analysis.

- Compute differences in expenditure across various cost categories.

- Examine the operation of a corporation via flexible financial plans.

Verified Answer

Variable expenses per tenant-day:

Food: $8.70

Supplies: $1.20

Total variable expenses per tenant-day: $9.90

Fixed expenses:

Salaries: $3,800

Rent: $1,400

Insurance: $600

Total fixed expenses: $5,800

Flexible budget: (2,320 tenant-days)

Variable expenses: 2,320 x $9.90 = $22,968

Fixed expenses: $5,800

Total expenses: $28,768

Now we can calculate the net operating income in the planning budget by subtracting the total expenses from the total revenue in the planning budget:

Planning budget revenue: 2,300 x $30.00 = $69,000

Planning budget total expenses: $24,800 (variable expenses: 2,300 x $9.90 + fixed expenses: $5,500)

Planning budget net operating income: $69,000 - $24,800 = $44,200

Finally, we can calculate the net operating income in the flexible budget by subtracting the total expenses from the total revenue in the flexible budget:

Flexible budget revenue: 2,320 x $30.00 = $69,600

Flexible budget total expenses: $28,768 (variable expenses: 2,320 x $9.90 + fixed expenses: $5,800)

Flexible budget net operating income: $69,600 - $28,768 = $40,832

Therefore, the net operating income in the planning budget for December would be closest to $9,890 (option B), which is the net operating income in the planning budget when the kennel anticipated 2,300 tenant-days.

Learning Objectives

- Gain insights into the theoretical underpinning and practical application of flexible budgets in variance analysis.

- Compute differences in expenditure across various cost categories.

- Examine the operation of a corporation via flexible financial plans.

Related questions

Younker Corporation Is a Shipping Container Refurbishment Company That Measures ...

Hirons Air Uses Two Measures of Activity, Flights and Passengers ...

Higgs Enterprise's Flexible Budget Cost Formula for Indirect Materials, a ...

Witten Corporation Is a Service Company That Measures Its Output ...

The Net Operating Income in the Flexible Budget for December ...