Asked by Nicholas Felix on Jun 15, 2024

Verified

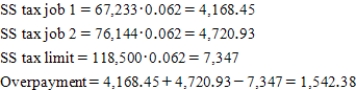

Juan changed jobs in 2016.He earned $67,233 working at an insurance company for the first 7 months of the year.When he switched jobs to a textbook company,he was able to negotiate a higher salary and earned $76,144 for the remainder of the year.How much can Juan expect his tax refund to increase in 2016 due to overpaying Social Security taxes?

Social Security Taxes

Taxes levied on both employers and employees to fund the Social Security program, which provides retirement, disability, and survivorship benefits.

Tax Refund

A tax refund is the return of excess taxes paid by an individual or business to the government, usually received after the annual tax return is processed.

- Acquire an understanding of the key elements of Social Security, particularly regarding benefit determination and taxation.

Verified Answer

QC

Learning Objectives

- Acquire an understanding of the key elements of Social Security, particularly regarding benefit determination and taxation.