Asked by Dejanece Thomas on May 07, 2024

Verified

Journalize the following transactions in the accounts of Simmons Company:?

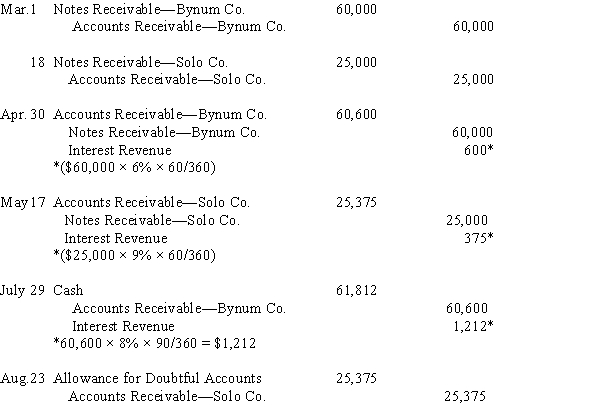

Mar. 1 Received a $60,000, 60-day, 6% note dated March 1 from Bynum Co. on account.18 Received a $25,000, 60-day, 9% note dated March 18 from Solo Co. on account.

Apr. 30 The note dated March 1 from Bynum Co. is dishonored, and the customer's account is charged for the note, including interest.

May 17 The note dated March 18 from Solo Co. is dishonored, and the customer's account is charged for the note, including interest.

July 29 Cash is received for the amount due on the dishonored note dated March 1 plus interest for 90 days at 8% on the total amount debited to Bynum Co. on April 30.

Aug. 23 Wrote off against the allowance account the amount charged to Solo Co. on May 17 for the dishonored note dated March 18.

Interest Revenue

Income earned by an entity for lending its money or letting another entity use its funds.

Dishonored Note

A promissory note that has not been paid by the maker when due, leading to a default.

Journalize Transactions

The process of recording business transactions in a company's journal, thereby providing a chronological record of financial activities.

- Transcribe dealings with notes receivable into accounting logs and estimate the corresponding interest.

- Journalize transactions related to notes payable and accounts receivable.

Verified Answer

AG

Learning Objectives

- Transcribe dealings with notes receivable into accounting logs and estimate the corresponding interest.

- Journalize transactions related to notes payable and accounts receivable.

Related questions

Watson Co Issued a 60-Day, 8% Note for $18,000, Dated ...

For Each of the Following Notes Receivables Held by Christensen ...

Journalize the Following Transactions of Upton Drugs:July 8Received a $180,000 ...

Journalize the Following Transactions ...

Journalize the Following Transactions for Lucite Company ...