Asked by Evette Juarez on May 23, 2024

Verified

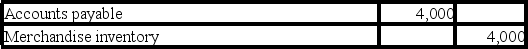

Johnson uses the periodic inventory system and the net method of accounting for purchases.The journal entry that Johnson will make on September 12 is:

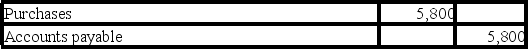

A)

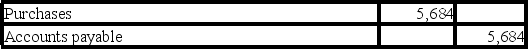

B)

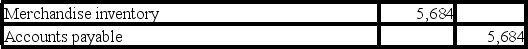

C)

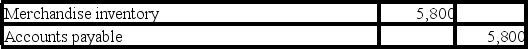

D)

E)

Periodic Inventory System

An inventory accounting system where the inventory count is physically conducted at specific intervals, typically at the end of an accounting period.

Net Method

An accounting method that records purchases and sales of inventory net of discounts at the time of transaction.

Credit Terms

Conditions under which credit is extended to a buyer, including the repayment time frame, interest rates, and penalties for late payment.

- Master the accounting techniques for merchandise transactions employing both gross and net methods.

- Execute the use of knowledge on periodic and perpetual inventory systems for journal entries in accounting.

- Explain how the net method diverges from the gross method in documenting purchases.

Verified Answer

Learning Objectives

- Master the accounting techniques for merchandise transactions employing both gross and net methods.

- Execute the use of knowledge on periodic and perpetual inventory systems for journal entries in accounting.

- Explain how the net method diverges from the gross method in documenting purchases.

Related questions

An Expense Resulting from Failing to Take Advantage of Cash ...

When Purchases Are Recorded at Net Amounts,any Discounts Lost as ...

The Net Method Records the Invoice at Its Net Amount ...

Either the Gross Method or Net Method May Be Used ...

Under the Periodic Inventory System, the Cost of Merchandise Sold ...