Asked by Spiro Billos on Jul 25, 2024

Verified

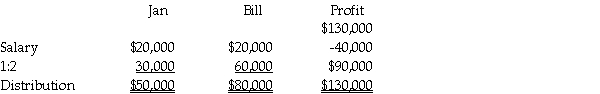

Jan and Bill have average capital balances of $35,000 and $20,000, respectively. The partners have agreed to allow $20,000 salary allowances. The partners will share income and losses in a 1:2 ratio for Jan and Bill, respectively. How much will each partner's capital account change if net income is $130,000?

Salary Allowances

Pre-determined sums paid to employees over their regular salary, allocated for specific purposes such as transportation, housing, or meals.

Income Distribution

The process by which earned income is distributed among various stakeholders, including dividends to shareholders and payments to other entities.

- Compute how changes in net income affect individual partner's capital accounts based on various agreements.

Verified Answer

JA

Learning Objectives

- Compute how changes in net income affect individual partner's capital accounts based on various agreements.