Asked by Isaiah Estilien on Jun 09, 2024

Verified

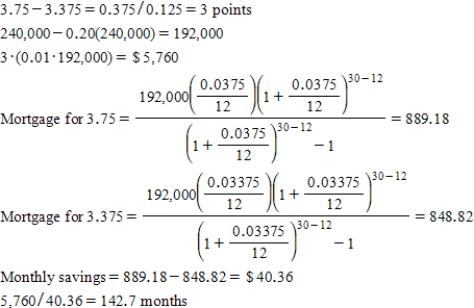

James and Amy have decided to buy a new home that costs $240,000.They want to make a 20% down payment and finance the rest over 30 years.Their bank has offered an opportunity to buy down the quoted interest rate of 3.75% by 0.125% per point purchased.Each point will cost 1% of the amount borrowed.James and Amy were hoping the interest rate was no more than 3.375%.How long will it take for the cost of the points to be recovered by the savings in the monthly mortgage payment?

Buy Down

A financing technique where points are paid upfront by a borrower to reduce the interest rate on a loan.

Point Purchased

In finance, particularly in mortgage contexts, this refers to prepaid interest that the borrower opts to pay upfront in order to lower the interest rate on the loan.

Monthly Mortgage

A regularly scheduled payment that often includes both interest and principal, made by a borrower to a lender for the repayment of a home loan.

- Evaluate the financial implications of buying points on a mortgage to reduce interest rates and determine the break-even point.

Verified Answer

RK

Learning Objectives

- Evaluate the financial implications of buying points on a mortgage to reduce interest rates and determine the break-even point.