Asked by Vonda Simpson on Jun 26, 2024

Verified

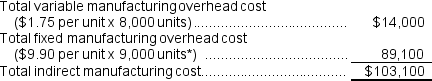

If 8,000 units are produced, the total amount of indirect manufacturing cost incurred is closest to:

A) $14,000

B) $93,200

C) $89,100

D) $103,100

Indirect Manufacturing Cost

Costs related to manufacturing that cannot be directly traced to specific units of product, similar to manufacturing overhead, including expenses like factory supervision.

Units Produced

The total quantity of products manufactured by a company during a specific period.

- Discern and compare the direct versus indirect costs encountered in manufacturing activities.

Verified Answer

IT

Ismael TorresJul 02, 2024

Final Answer :

D

Explanation :  *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by 9,000 units.

*The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by 9,000 units.

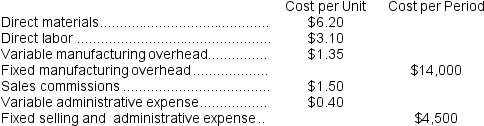

Reference: CH01-Ref8

Kesterson Corporation has provided the following information:

*The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by 9,000 units.

*The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by 9,000 units.Reference: CH01-Ref8

Kesterson Corporation has provided the following information:

Learning Objectives

- Discern and compare the direct versus indirect costs encountered in manufacturing activities.

Related questions

If 3,000 Units Are Produced, the Total Amount of Indirect ...

All of the Following Statements Regarding Manufacturing Costs Are True ...

A Factory Supervisor's Salary Would Be Classified as an Indirect ...

Which of the Following Manufacturing Costs Is an Indirect Cost ...

All of the Following Could Be Considered a Direct Material ...